Article content

(Bloomberg) — Taiwan central bank Governor Yang Chin-long indicated inflation is becoming less of a concern for the island’s economy, comments that come a week before a key decision on rates.

“CPI, core CPI, important staples prices and commonly purchased items prices are gradually falling,” Yang told lawmakers during a regular question-and-answer session on Thursday. “The economy is recovering but it’s not very strong,” he added.

Article content

The central bank will take into account global monetary policy conditions when it sets interest rates, Yang said. Those remarks come as Canada just took the lead in Group of Seven nations cutting rates.

Taiwan’s interest-rate swaps – a measure of trader expectations for rate hikes – fell after Yang’s remarks. The three-year IRS dropped as much as 5.5 basis points, the most since late March.

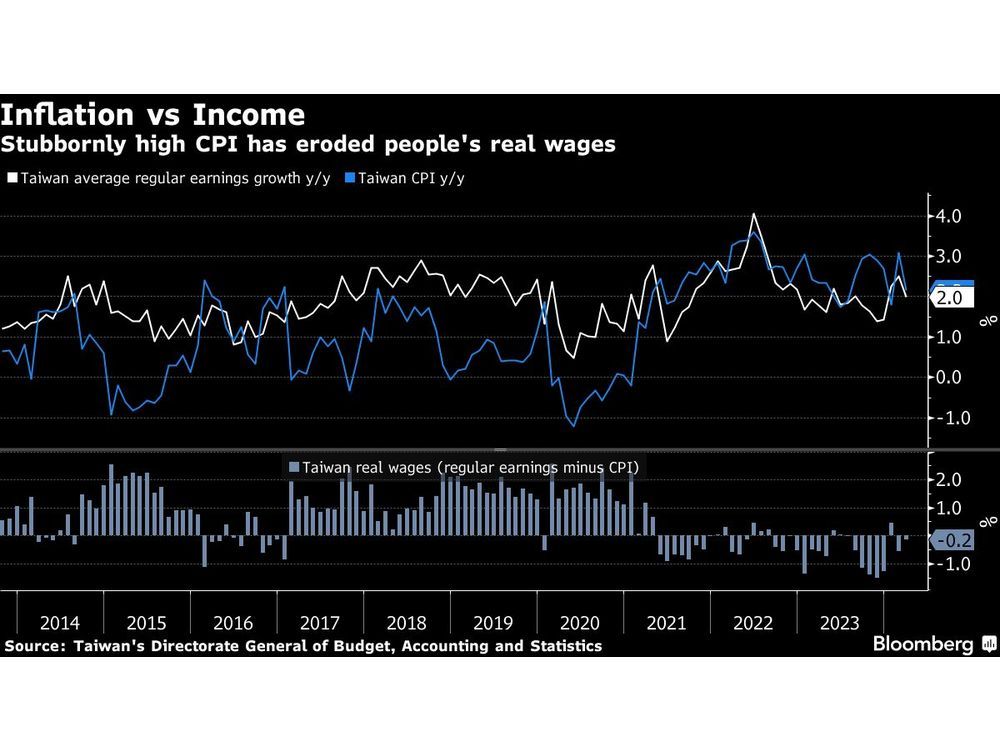

While Taiwan expects the economy to grow this year at the fastest pace since 2021, inflation has been a key concern for policymakers and the public. Although the pace of price gains has been low compared to elsewhere in the world, even slower wage gains has meant the erosion of household earnings.

Taiwan’s inflation rate fell below the central bank’s desired 2% threshold in April. The island is set to report inflation data for May later on Thursday, with economists surveyed by Bloomberg News expecting a CPI reading of 2.1%.

Frustration over cost-of-living issues is one of the top challenges facing new President Lai Ching-te, who won election in January with just 40% of the vote. His Democratic Progressive Party also lost control of the legislature, complicating the outlook for his policymaking.

Article content

In response to public angst over rising prices, Lai has promised to bolster wages and support small and medium-sized business to better distribute the benefits of economic growth.

In March, Taiwan’s central bank unexpectedly raised its benchmark interest rate to the highest since 2008. Yang said at the time that “inflation has been high since 2021,” and singled out concern over electricity costs.

The island has had to boost those prices to help stem losses at the government-owned Taiwan Power Co. due to higher fuel costs.

Also on Thursday, Yang repeated that interest rates won’t be used to influence property prices.

Climbing home prices are a lingering concern in Taiwan. Earlier this week, the Taipei-based Commercial Times reported that some commercial lenders think the central bank may decide to tighten mortgage lending rules at its meeting next week.

(Updates with Taiwan interest rate swaps falling.)

Share this article in your social network