Article content

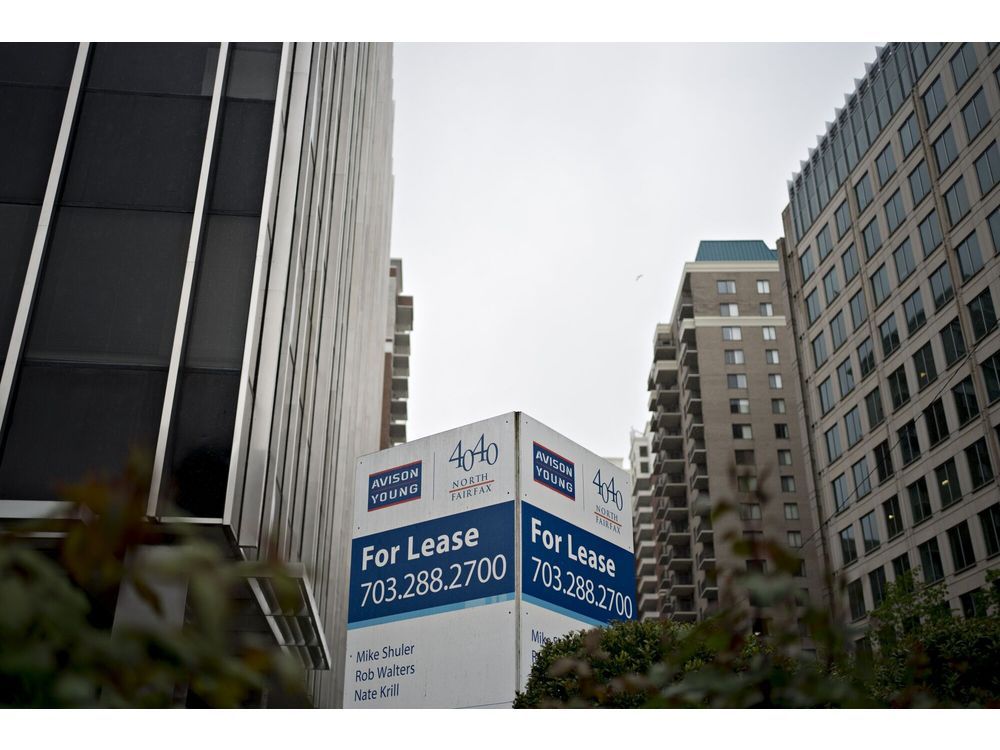

(Bloomberg) — Real estate services firm Avison Young (Canada) Inc. says it’s close to finishing a restructuring to clean up its balance sheet after it defaulted on a senior term loan, causing a ratings downgrade.

“We have been focused on finalizing a transaction with our financial partners which will significantly strengthen Avison Young for the future,” spokesperson Andrea Zviedris said in an email to Bloomberg. “We are at the finish line of this process and anticipate that the ratings agencies will review our post-transaction debt structure and issue a new, improved rating in the coming weeks.”

Article content

Avison Canada missed principal and interest payments in the third and fourth quarters of 2023, S&P Global Ratings said in a statement that downgraded the firm to SD, for selective default. S&P’s action was expected, Zviedris said.

Avison is a competitor to firms such as CBRE Group Inc. in handling real estate sales, property management, leasing and other services in the commercial real estate sector. Business has been slow as the commercial property market endures one of its worst downturns in a generation.

In September, S&P lowered its rating on Avison Canada to CCC with a negative outlook, saying the company needed additional sources of cash. Avison had about C$23 million ($17 million) in net cash outflows from operating activities — excluding cash interest payments — in the first half of last year, partly because of lower capital markets and leasing revenue, S&P said at the time.

(Updates with new information from Avison, beginning in first paragraph)

Share this article in your social network