Article content

(Bloomberg) — The International Monetary Fund said global growth will slow this year more than it previously forecast, partly because of recent stress in the financial sector.

The International Monetary Fund said global growth will slow this year more than it previously forecast, partly because of recent stress in the financial sector.

(Bloomberg) — The International Monetary Fund said global growth will slow this year more than it previously forecast, partly because of recent stress in the financial sector.

Story continues below

The fund’s chief economist said banks will be somewhat “more prudent” in lending going forward. Some of the biggest US banks reported higher income from lending in the past year as the Federal Reserve raised interest rates.

Planned oil production cuts by OPEC+ are already heralding higher prices, amplifying recession risks as consumers will have less money to spend elsewhere. US inflation cooled only a bit last month, but price pressures remain elevated.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

The IMF trimmed its global-growth projections, warning of high uncertainty and risks as financial-sector stress adds to pressures emanating from tighter monetary policy and Russia’s war in Ukraine.

Story continues below

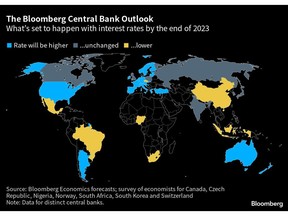

Most global central banks may be either close to a peak or already done with interest-rate hiking, auguring a hiatus before possible monetary loosening comes into view. Policymakers in South Korea, Canada and Peru stayed on hold this week.

Oil supply cuts agreed by OPEC+ nations are putting global markets on track for a hefty supply deficit that will widen as the year progresses. World markets may be under supplied by about 2 million barrels a day in the fourth quarter as a result of cutbacks announced by Saudi Arabia and its partners, according to figures in a report from the Organization of Petroleum Exporting Countries.

US

A key measure of US inflation showed hints of moderating in March, but likely not by enough to dissuade the Federal Reserve from raising interest rates again next month.

Story continues below

Just three years ago, when OPEC+ oil giants fell out, the US found itself playing the role of peacemaker. Now it looks more like their target. The announcement of output cuts, which lifted oil prices by about $5 a barrel, already means recession risks are bigger than they otherwise would have been — because consumers spending more on energy will have less cash left for other stuff — and inflation will be higher.

JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. are reeling in windfalls from higher interest rates that upended smaller lenders last month. All three firms said income from lending jumped from a year earlier after Fed rate hikes, compared to regional lenders that saw a flood of withdrawals and precipitous stock drops last month.

Story continues below

Europe

Britain’s money-supply economists, who emerged from obscurity in the pandemic by correctly anticipating sky-high inflation before anyone else, are sounding the alarm again. Money supply growth is collapsing in the UK, eurozone and US, and they read that as a warning of recession and deflation.

Asia

China’s consumer and producer inflation remained muted in March, suggesting more monetary or fiscal stimulus may be needed to strengthen the economy’s recovery. The consumer price index rose 0.7% last month from a year ago, less than the 1% forecast by economists. Producer price deflation worsened to 2.5%, the lowest since June 2020.

China’s exports unexpectedly rose in March as demand from most Asian countries and Europe improved and the nation’s factories resumed production, boosting the economy’s outlook and indicating global growth may be better than expected.

Story continues below

Emerging Markets

South African President Cyril Ramaphosa set a target of attracting 2 trillion rand ($110 billion) of new investment in the next five years, as executives pleaded with his government to urgently address the nation’s energy crisis, fix crumbling infrastructure and end rampant crime. The energy crisis alone is robbing the economy of as much as 899 million rand a day, according to the nation’s central bank.

—With assistance from Philip Aldrick, S’thembile Cele, Ziad Daoud (Economist), Katherine Doherty, John Liu, Yujing Liu, Eric Martin, James Mayger, Courtney McBride, Amogelang Mbatha, Reade Pickert, Zoe Schneeweiss, Grant Smith and Craig Stirling.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation