Article content

(Bloomberg) — Asian stocks were mostly set to open weaker after US equities pulled back from a rally that drove the S&P 500 to multiple records, spurring speculation the market has gone too far, too fast.

Futures showed shares in Australia will decline Tuesday, with Hong Hong’s benchmark to start flat and Japan edging slightly higher. On Wall Street, the S&P 500 closed lower at the start of a week that will bring the Federal Reserve’s preferred inflation measure.

Article content

Investors took a cautious stance on bets the personal consumption expenditures price index — due on Good Friday when markets will be closed — will show inflation probably remained uncomfortably high. On that same day, Jerome Powell is due to speak.

On Monday, a sense of prudence prevailed as concern about a disconnect between earnings expectations and share prices have grown. Morgan Stanley and JPMorgan Chase & Co. strategists were the latest to warn it’ll be hard to justify lofty valuations if profit acceleration fails to materialize.

“We continue to see sentiment as stretched and think a US equity market pullback is overdue,” said Lori Calvasina at RBC Capital Markets.

In a sign of how overheated the stock market has been, the S&P 500 finished last week 14% above its 200-day moving average.

“That’s quite stretched historically,” said Jonathan Krinsky at BTIG. “The big question is: do we get a correction through time, or price. The latter has been elusive for the last five months, but we do think there is a window here for some modest price weakness.”

In Asia, focus has been on the region’s two biggest central banks seeking to counter speculative moves in foreign exchange markets.

Article content

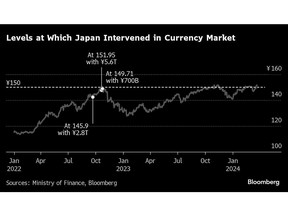

China’s yuan pared losses seen Friday after the central bank signaled its support for the managed currency via a stronger-than-expected daily reference rate. Meanwhile, Japan’s top currency official said the yen’s decline to hover near a 2022 intervention level was “not in line with fundamentals and is clearly driven by speculation.”

The combination of healthy US economic data, expectations the Fed will cut rates and optimism about artificial intelligence have all driven the S&P 500 up almost 10% this year — leaving many year-end forecasts in the dust.

Goldman Sachs Group Inc. strategists are sticking with their year-end prediction of 5,200 — but have a scenario in which tech megacaps lead the index up to 6,000.

“Although AI optimism appears high, long-term growth expectations and valuations for the largest TMT stocks are still far from ‘bubble’ territory,” the strategists led by David Kostin wrote.

The pro-risk mood among equity investors is likely to spread beyond the megacap technology names that have comprised much of the stock market’s returns into other sectors, according to strategists at BlackRock’s Investment Institute.

Article content

Strong corporate earnings, economic resilience in the face of higher interest rates and “prospects for innovation” have prompted Oppenheimer Asset Management’s John Stoltzfus to raise his year-end target on the S&P 500 to 5,500 — joining Societe Generale for the highest forecast on Wall Street.

“The big surprise this year has not been so much the resilience of the economy, but rather the substantial capitulation among the bears and bearish community,” Stoltzfus said. Profit taking, particularly in Big Tech, is expected and normal — and any near-term volatility is opportunity to “catch babies that get thrown out with the bath water,” he noted.

In other markets, gold edged up on Monday toward last week’s record high, while oil futures rose on geopolitical unrest and signs that OPEC+ will stick with current output cuts when delegates hold a review session next week. Both were little changed early Tuesday.

Corporate Highlights:

- Apple Inc., Alphabet Inc.’s Google and Meta Platforms Inc. face the risk of potentially hefty fines as the European Union opened a full-blown investigation into the firms’ compliance with strict new laws reining in the power of Big Tech.

- Take-Two Interactive Software Inc.’s tumbled on fears of a possible delay to the much-anticipated Grand Theft Auto VI video game.

- US aviation authorities are considering drastic measures to curb growth at United Airlines Holdings Inc., including preventing the carrier from adding new routes, following a series of safety incidents.

- Lucid Group Inc. is getting a $1 billion cash injection from its biggest investor, an affiliate of Saudi Arabia’s Public Investment Fund, providing the troubled electric carmaker with a needed lifeline.

- Manulife Financial Corp. has struck another deal to offload some of its less-profitable assets, agreeing to reinsure C$5.8 billion ($4.3 billion) of Canadian policies with RGA Life Reinsurance Co. of Canada.

- Match Group Inc., the owner of dating apps Tinder and Hinge, named two directors to its board following discussions with activist investor Elliott Investment Management.

- Novo Nordisk A/S agreed to buy Cardior Pharmaceuticals for up to €1 billion ($1.1 billion) as the Danish maker of weight-loss drugs continues to expand into treatments for cardiovascular disease.

Article content

Key events this week:

- ECB chief economist Philip Lane participates in event in Dublin, Tuesday

- US durable goods, Conference Board consumer confidence, Tuesday

- China industrial profits, Wednesday

- Bank of England issues financial policy committee minutes, Wednesday

- Eurozone economic confidence, consumer confidence, Wednesday

- Fed Governor Christopher Waller speaks, Wednesday

- UK GDP revision, Thursday

- US University of Michigan consumer sentiment, initial jobless claims, GDP, Thursday

- Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

- US personal income and spending, PCE deflator, Friday

- Good Friday. Exchanges closed in US and many other countries in observance of holiday. US federal government is open.

- San Francisco Fed President Mary Daly speaks, Friday

- Fed Chair Jerome Powell speaks, Friday

Some of the main moves in markets:

Stocks

- Hang Seng futures were little changed as of 7:27 a.m. Tokyo time

- S&P/ASX 200 futures were 0.4% lower

- Nikkei 225 futures rose 0.2%

- The S&P 500 fell 0.3%

- The Nasdaq 100 fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was unchanged at $1.0837

- The Japanese yen was little changed at 151.41 per dollar

- The offshore yuan was little changed at 7.2536 per dollar

Cryptocurrencies

- Bitcoin fell 0.9% to $70,336.79

- Ether fell 0.6% to $3,605.32

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.25%

- Australia’s 10-year yield advanced four basis points to 4.04%

Commodities

- Spot gold was little changed at $2,172.40 an ounce

- West Texas Intermediate was little changed at $82 a barrel

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Rita Nazareth.

Share this article in your social network

Comments