Article content

(Bloomberg) — US market turmoil triggered by tariffs and a slowing economic outlook is boosting the appeal of Chinese corporate debt that less than six months ago was considered uninvestable by some credit managers.

US market turmoil triggered by tariffs and a slowing economic outlook is boosting the appeal of Chinese corporate debt that less than six months ago was considered uninvestable by some credit managers.

(Bloomberg) — US market turmoil triggered by tariffs and a slowing economic outlook is boosting the appeal of Chinese corporate debt that less than six months ago was considered uninvestable by some credit managers.

Article content

Article content

“There’s been a lot more focus on China,” Winnie Cisar, global head of strategy at CreditSights, said on the Credit Edge podcast this week. “The US seems to be sneezing an awful lot lately and the rest of the world is saying: Well how do we mask up and try to defend ourselves against this?”

Advertisement 2

Story continues below

Article content

US high-yield credit markets led the world in performance in the month after Donald Trump’s November presidential election victory, which fueled high hopes of economic stimulus and deregulation. Trade war fears have since fractured market complacency, turning that debt into a laggard. Meanwhile, Chinese credit is rebounding, following on from a surge in equities that was driven by fiscal and monetary stimulus.

“Investors may be starting to look back at China,” said Omotunde Lawal, head of emerging markets corporate debt at Baring Investment Services. It’s still a “little bit cheap” even though spreads have a rallied a bit given the “renewed government focus on technology, a 5% growth target and the benefits that the AI advances can bring to Chinese industrials and consumer companies.”

Click here to hear CreditSights’ Cisar discuss global portfolio allocations

Chinese corporates are taking advantage of the window of interest, raising $15 billion so far this year in the dollar bond market, the most for the period since 2022. Even real estate firms are showing signs of life. Beijing Capital Group is considering raising as much as $500 million in debt, just weeks after tapping hungry dollar debt investors for $450 million.

Article content

Advertisement 3

Story continues below

Article content

Cisar notes growing investor interest in Chinese technology firms. Search engine Baidu Inc. this month sold 10 billion yuan-denominated bonds outside of the mainland — its first debt issuance since 2021. A $2 billion exchangeable bond swiftly followed and was several times oversubscribed.

To be sure, property is still seen as a risk. And Asia’s largest economy remains highly exposed to any escalation in the trade wars and would ultimately be hit by any US economic downturn.

“It is notable that the only US tariffs that have not been delayed or alleviated are those imposed on China on Feb. 4 and March 4,” said Paul Mackel, global head of FX research at HSBC Holdings Plc. “It is likely that more tariffs or other actions could be announced after the US administration finishes its various reviews on China’s trade. Tariff-induced depreciation pressure on the renminbi is, therefore, still very high.”

Xuchen Zhang, an emerging markets credit analyst at Jupiter Asset Management, is cautious about market complacency for China debt given some issuers “have been trading down to single digit yield without a clear and sustainable path to address maturities.”

Advertisement 4

Story continues below

Article content

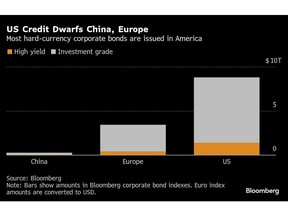

In addition, American corporate debt markets are so much larger than others that large money managers are naturally forced to buy. But fund flows track performance and rising US policy uncertainty incentivizes investors to park more of their cash elsewhere.

And “the seemingly good return in 2024 and this year to date from China high-yield credit is a function of policy turnaround, survivor bias and horizon bias,” Zhang said. “We are left with a far higher quality and smaller investment universe which supports overall price recovery from both fundamental and technical perspective.”

Week In Review

Advertisement 5

Story continues below

Article content

On the Move

—With assistance from Rheaa Rao.

Article content

Comments