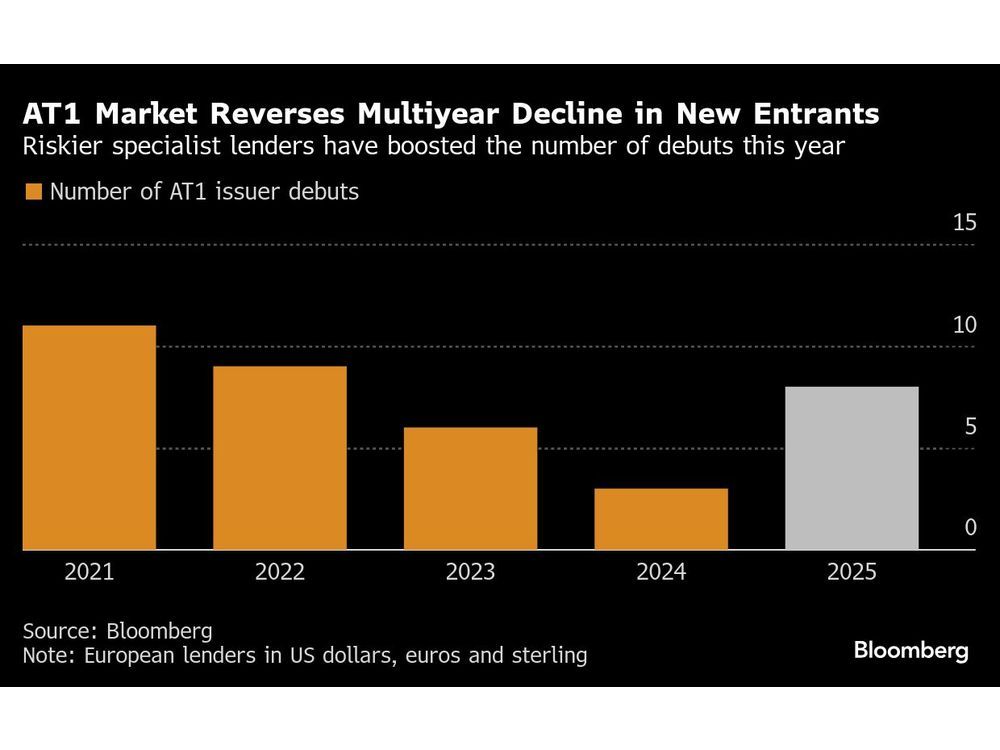

New entrants, including Metro Bank Holdings Plc, UTB Partners Plc and Zopa Group Ltd., are flocking to AT1s because they are a cheaper way to raise capital than equity, given a backdrop of tight spreads and the stock-market volatility unleashed by US President Donald Trump. And investors are keen to put cash to work in higher-yielding debt that is seen as relatively insulated from tariff turmoil.