Article content

(Bloomberg) —

Emirates Global Aluminium PJSC, whose shareholders are considering an initial public offering, posted a record first-half profit as prices of the metal soared.

(Bloomberg) —

Story continues below

Emirates Global Aluminium PJSC, whose shareholders are considering an initial public offering, posted a record first-half profit as prices of the metal soared.

Profit rose almost fourfold to 5.9 billion dirhams ($1.6 billion), the Middle East’s biggest aluminum producer said Tuesday. That exceeded the profit the firm reported for the whole of last year. Revenue jumped about 70% to 18.3 billion dirhams.

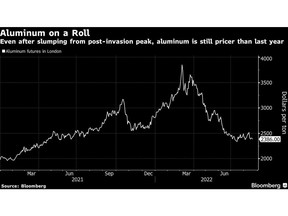

Aluminum, used in everything from beer cans to plane parts, averaged about 36% higher in London over the first half of the year compared with the year-earlier period after Russia’s invasion of Ukraine roiled markets. Prices have since dropped from the highs reached in March, with aluminum trading at $2,394 a ton on the London Metal Exchange. EGA warned of tougher conditions.

Story continues below

“We expect the market conditions to be more challenging the second half of the year,” Chief Executive Officer Abdulnasser bin Kalban said in an interview. “We remain well on the course for a strong and incredible year overall.”

Aluminum will likely average less than $3,000 a ton for the second half, Chief Financial Officer Zouhir Regragui said on the same call. Over the next 12 months, the company will be watching global demand, China’s exit from restrictive coronavirus policies and soaring energy prices for their impact on the market.

“We do expect this to be a story of two halves,” Regragui said. “The economic outlook is uncertain and prices have come down.”

China’s power crunch is adding to the risks posed by the energy crisis in Europe, where about half the region’s aluminum and zinc capacity has been closed in the past year due to soaring costs. At current prices, about 20% of global aluminum production is unprofitable, En+ Group, the parent company of Russian aluminum giant United Co. Rusal International PJSC, said last week.

Story continues below

IPO Option

The owners of EGA, which has operations in Dubai and Abu Dhabi, are considering an IPO. The firm is equally owned by two sovereign wealth funds — Investment Corp. of Dubai and Abu Dhabi’s Mubadala Investment Co. — and a listing could value EGA at $15 billion or more.

Any plan to sell shares is up to EGA’s owners and no decision has yet been taken, Kalban said.

EGA increased metal sales by 11% in the first half. The company also boosted exports from a bauxite mine in Guinea by the same amount.

The firm paid an interim dividend of 2.2 billion dirhams to shareholders at the end of the first half, and repaid 2.9 billion dirhams of debt to strengthen its balance sheet. The company will continue paying down debt, Regragui said, without providing a target.

Since the start of last year, EGA has paid off about $1.8 billion in debt and has another $4.7 billion in outstanding borrowings.

EGA is working to improve efficiency at its power plants, which will help it deal with increases in energy prices, Kalban said. At the same time, it’s continuing to negotiate a deal to sell its power assets to Abu Dhabi’s largest electricity producer and to purchase energy from the national grid, including more renewable supplies.

(Adds comments from CEO and CFO from fourth paragraph.)

Story continues below