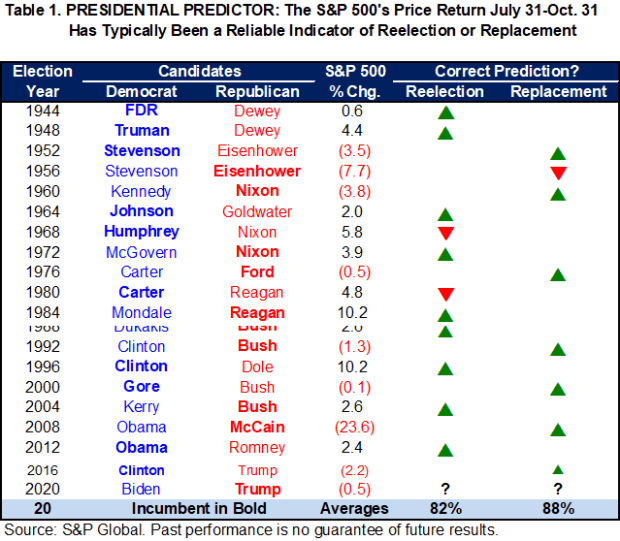

The stock market’s Friday fall spells trouble for President Donald Trump’s re-election hopes.

The “Presidential Predictor,” popularized by Sam Stovall, CFRA’s chief investment strategist, tracks the S&P 500 index’s SPX,

A late bounce trimmed a decline for the S&P 500 on Friday, the last trading day of October, but it wasn’t enough. The index finished the day down 40.15 points, or 1.2%, to close at 3,269.96, leaving it below the July 31 close at 3,271.12.

“The Presidential Predictor implies, but does not guarantee, a Biden victory,” Stovall said, in an email, after the closing bell.

Polls show Democratic challenger Joe Biden leading Trump nationwide, though his advantage has narrowed in recent weeks. Biden is also seen ahead in key battleground states, though strategists see some scope for Trump to pull out an Electoral College victory, but his path appears more difficult than in 2016.

The Real Clear Politics average of national polls on Friday showed Biden with a 7.8 percentage point lead over Trump.

See: Biden, Trump hold Florida rallies hours apart, as Democrat retakes lead in crucial state’s polls

Fears of a contested election outcome, in which results aren’t clear for days or even weeks amid legal and political wrangling have been cited as a big worry for investors.

The stock-market metric doesn’t have a perfect record. It failed to call the correct outcome in 1956, when Republican President Dwight Eisenhower defeated Democratic challenger Adlai Stevenson despite a 7.7% fall for the index in the three-month period.

The indicator twice failed to correctly predict defeat for the incumbent party — in 1968, when Republican Richard Nixon defeated Democratic nominee Hubert Humphrey; and 1980, when Ronald Reagan defeated Democratic President Jimmy Carter.

All three instances in which the predictor failed were accompanied by extraordinary geopolitical factors, Stovall noted. The 1956 stock-market weakness was tied to the Suez Crisis, following Egyptian President Gamal Abdel Nasser’s decision to nationalize the Suez Canal, and the Hungarian Uprising, which was crushed by Soviet troops, amplifying Cold War tensions.

The 1968 election, despite the buoyant stock market, was dominated by the Vietnam War, while the Iran hostage crisis was a key issue in the 1980 election.

This time around, the market’s weakness in the run-up to the vote “is being driven by the renewed surge in COVID-19 and what it portends for future GDP/EPS growth,” Stovall said, referring to gross domestic product and earnings per share.

The S&P 500 traded at a record on Sept. 2, but subsequently pulled back. The S&P 500, the Dow Jones Industrial Average DJIA,

Along the same concept, Ryan Detrick, chief financial markets strategist at LPL Financial, has look backed at the market’s performance in the three month period ending on Election Day going back to 1928. That period this year runs from Aug. 3 to Nov. 3.

It’s also on track to signal a Biden victory. The S&P 500 would need to finish above the Aug. 3 close of 3,294.61 to turn it in favor of Trump.