President Whatever.

For Jani Ziedins, the trader behind the Cracked Market blog, it simply doesn’t matter, from an actionable perspective, who ends up winning the White House. The market has a mind of its own.

“I don’t subscribe to the conventional wisdom that Republicans are better for stocks,” he wrote in a note Tuesday night as the votes were being tallied. “I’ve been trading for more than 30 years and some of the market’s best years occurred when Democrats occupied the White House and some of the worst bear markets started on Republican’s watch.”

In his view, what happens next with COVID and the economic stimulus will have a much greater impact in the coming weeks and months. Before that, however, there will likely be a “knee-jerk” move due to “deeply ingrained clichés” as the winners celebrate and the losers pick up the pieces.

For active traders looking to turn a quick buck in the aftermath of Election Day, it’s more about profiting from the ebbs and flows of the market. And there promises to be plenty volatility VIX,

At last check, traders were feeling jittery, as futures on the Nasdaq Composite NQ00,

“Don’t pay attention to this overnight noise. Only inexperienced, impulsive retail traders are participating in this after-hours nonsense,” Ziedins wrote. “The only thing that matters is what big money thinks and we won’t know their opinions until tomorrow afternoon.”

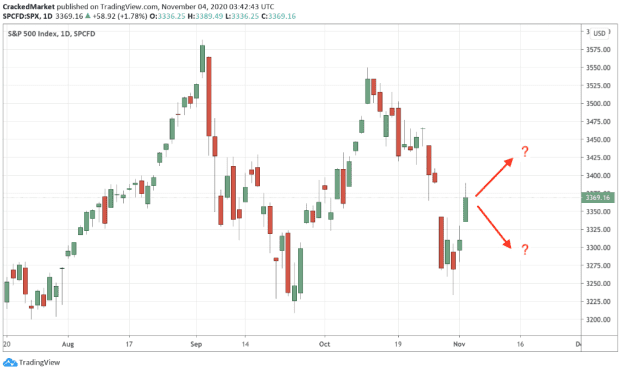

His advice: Trade the opening move. “If it rallies from the open, buy it. If prices retreat from the open, short it,” he said. “Start small, get in early, and place a stop on the other side of the open.”

If that first move fizzles out, he suggests flipping and taking the other side. “More often than not, this second move is the real move and given how volatile the market’s been lately, expect this next move to cover multiple percent,” Ziedins wrote. “If the market continues to trade strongly in that direction through the afternoon, add more and consider holding overnight. Most likely once this freight train starts moving, it will keep moving in the same direction for a few days.”