Article content

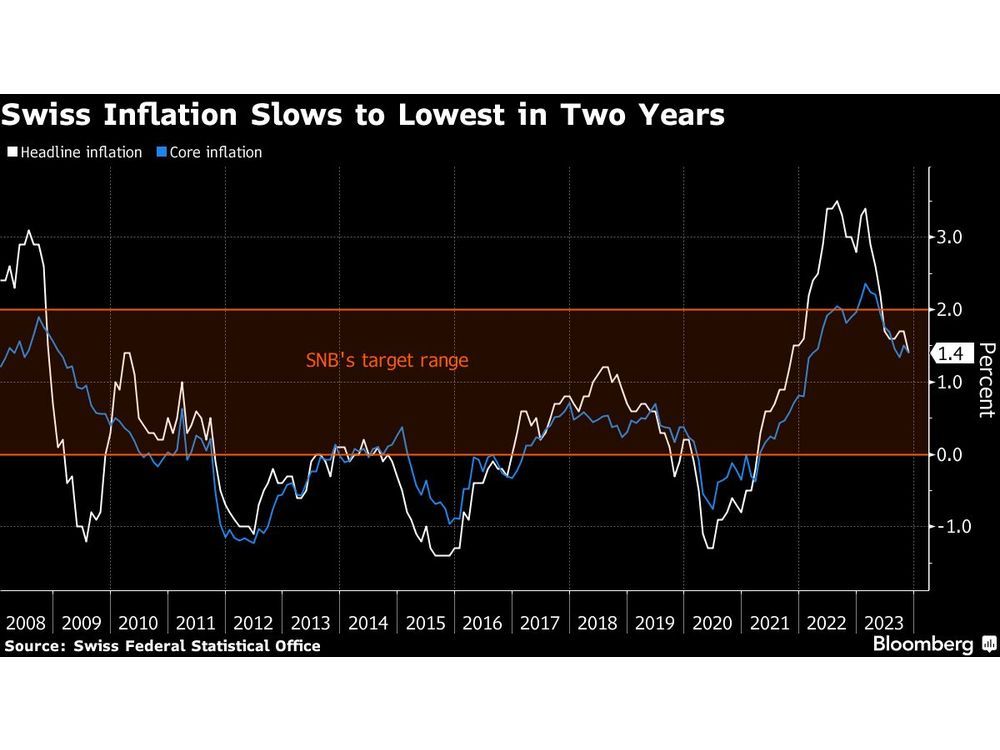

(Bloomberg) — Swiss inflation unexpectedly slowed to a two-year low, adding to the case for Swiss National Bank officials to keep borrowing costs steady when they meet next week.

Consumer prices rose 1.4% in November from a year earlier, the weakest since October 2021. That was lower than predicted by any economist in a Bloomberg survey, which foresaw no change from 1.7%. The drop was driven by lower costs for hotels, package holidays, fuel and fruit and vegetables

Article content

The so-called core gauge, which strips out volatile elements like energy and food, also decelerated to 1.4%, the Swiss statistics office said Monday.

With Switzerland’s inflation rate keeping within the central bank’s target range of between 0 and 2%, the SNB paused hiking in September. Officials led by President Thomas Jordan have been careful to stress that more tightening might be required.

“We can’t yet declare that inflation has been completely defeated,” Jordan said in an NZZ interview late last month. “There is great uncertainty about future developments.”

The SNB predicts inflation will breach the target range all of next year, driven by higher costs of electricity, rents and public transport, combined with a boost in value-added tax. Power prices alone are set to rise an average 18% in January.

Still, Swiss consumer-price growth remains lower than many advanced economies, showcasing how the country’s strong currency has sheltered it from the ravages of inflation elsewhere.

Euro-area data last week revealed that price growth dropped to 2.4% there. Based on the European Union’s harmonized measure, Swiss inflation was 1.6% in November.

Switzerland’s economy has also fared more comfortably that its neighbors. Gross domestic product increased 0.3% in the third quarter, and the OECD predicts it will expand 0.8% this year. That’s ahead of the 0.6% forecast for the euro area, which contracted in the three months through September.

—With assistance from Kristian Siedenburg, Joel Rinneby and Sonja Wind.

Share this article in your social network