Article content

(Bloomberg) — Asian central banks’ need for assertive defense of their currencies is driving traders to turn less dovish on monetary policies in the region.

Interest rate swaps for South Korea, Malaysia, and Thailand all jumped in recent weeks, a sign that traders are paring rate-cut expectations in those emerging markets. The Bloomberg Asia Dollar Index fell 0.8% in April, set for the fourth straight monthly decline, as solid US economic data and more hawkish bets for the Federal Reserve steer investors to the dollar.

Article content

“With later and fewer Fed rate cuts, we also adjust our forecasts for Asian central banks – projecting a later start for an even shallower rate cut path,” Morgan Stanley economists including Chetan Ahya wrote in a note dated April 15. China, South Korea, Indonesia, the Philippines and Taiwan particularly are the markets that will likely see rate cut delays, they said.

For now, the region’s central banks have generally stuck to non-rate tools to support local currencies. More aggressive policy action may be needed if the weakness persists, with higher-for-longer rates or even a resumption of rate hikes being possible options.

Here are three charts that show how rate cut expectations have ebbed in emerging Asia:

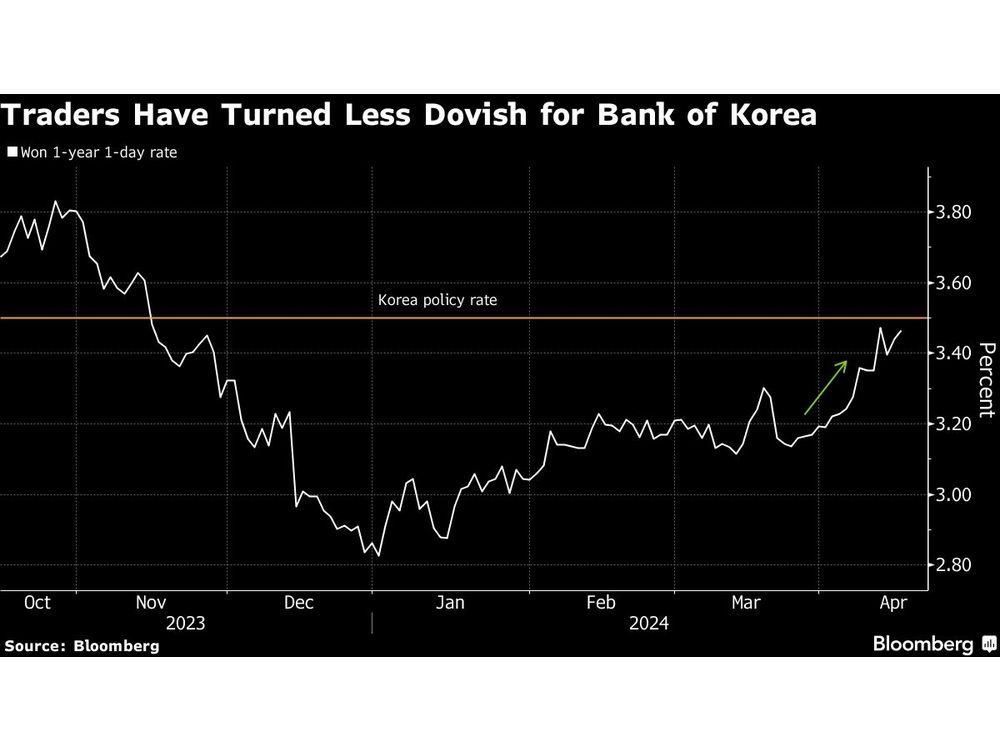

1. South Korea

Traders are pricing around a 5-basis point cut over the next twelve months, reining in their expectations for a full quarter-point cut at the end of March, according to Bloomberg-compiled data. As a net energy importer, elevated oil prices are driving import prices higher and threaten policymakers’ efforts to combat inflation. “With the strong data coming from US and oil price going higher, the ‘high for longer’ theme has come back to markets again,” BNP Paribas’ global markets strategists Chandresh Jain and Parisha Saimbi wrote in an April 15 note. The probability of rate cuts “from Bank of Korea will decrease if this persists.”

Article content

2. Thailand

Traders are pricing around 15-basis points of easing from the Bank of Thailand over the next six months, down from expectations at the end of March for nearly 50 basis points, according to Bloomberg-compiled data. “In our view, the hawkish tone at BOT’s April meeting and later Fed cuts have reduced the chance of a BOT rate cut in June,” Goldman Sachs Group Inc. analysts including Danny Suwanapruti wrote in an April 11 note. They are penciling in only two quarter-point cuts in the second half of the year, cooling from earlier expectations of a cumulative 75-basis point reduction.

3. Malaysia

Traders have turned slightly more hawkish for Bank Negara Malaysia since the end of March, based on ringgit one-year one-day swaps, according to Bloomberg-compiled data. The ringgit’s persistent weakness has pushed back expectations for a rate cut further into 2025, despite the country’s sluggish economy. The Malaysian policy rate’s record discount to the upper bound of the Fed’s benchmark — at 250 basis points — has been one of the main reasons behind the currency’s weakness. BNM has already resorted to encouraging state-linked firms to more consistently repatriate foreign investment income and to convert it into the local currency.

Share this article in your social network