Article content

(Bloomberg) — Russia’s war in Ukraine has made the now-treacherous waters of the southern Red Sea a vital global trade corridor for oil — especially Moscow’s own exports.

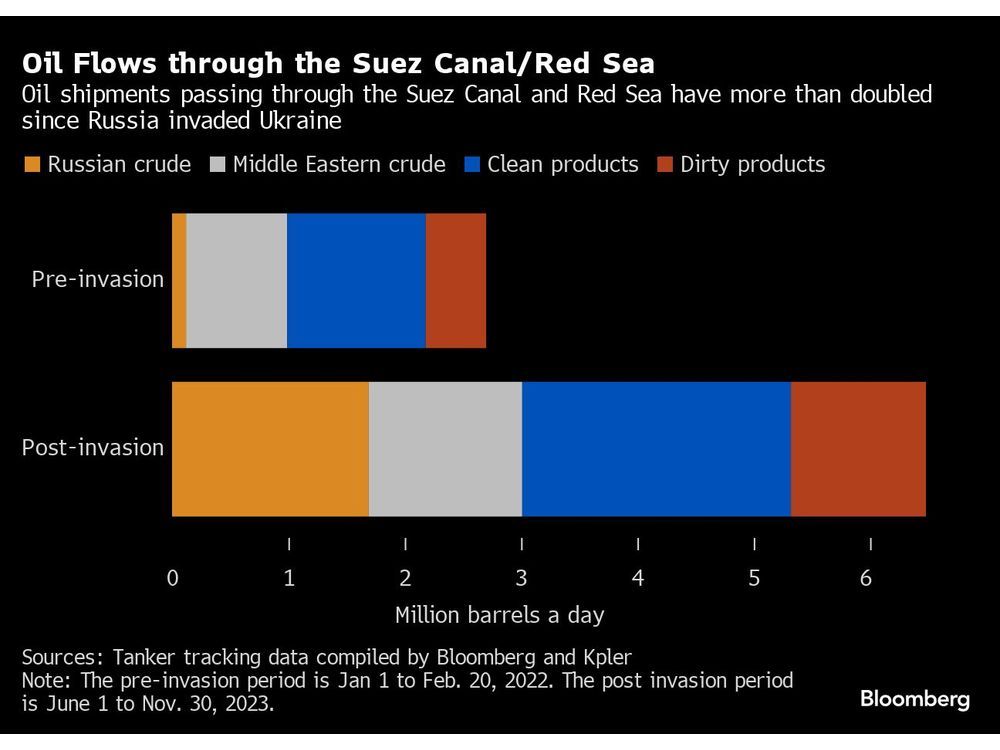

As Europe has shunned Russian barrels, it has increasingly relied on cargoes from the Middle East. Meanwhile, Moscow has boosted flows to Asia as it seeks outlets for its exports. That’s raised the movement of oil through the Red Sea, both northbound and southbound, by around 140%, to 3.8 million barrels a day.

Article content

The surge highlights the vulnerability of a key chokepoint for oil flows as global powers redraw the world’s energy trade map. In recent days, a major escalation of attacks on merchant ships by Yemen-based Houthi militants has caused companies including BP Plc and Equinor ASA to halt shipments and reroute vessels, with oil prices initially rising on the news.

Read: Houthi Attacks Start Shutting Down Red Sea Merchant Shipping

The incidents have prompted the US and its allies to establish a task force in the region to counter the attacks. But the strikes on shipping have also drawn attention to just how much oil is moving through the Red Sea and Suez Canal.

In the two months prior to its attack on Ukraine, Russia sent about 120,000 barrels a day of crude from its western ports to markets east of Suez, tanker-tracking data compiled by Bloomberg show. In the past six months, that figure has averaged 1.7 million barrels a day.

Over the same period, crude shipments from the Middle East to European countries have jumped from about 870,000 barrels a day to 1.3 million barrels a day.

Article content

Shipments of petroleum products through the Suez Canal have more than doubled since Russia began its invasion of Ukraine, according to information from analytics firm Kpler, compiled by Bloomberg.

During the same period in early 2022, shipments that eventually passed through the Suez Canal totaled 1.7 million barrels a day. From June 1 to the end of November this year, that figure had jumped to 3.5 million.

The jump was largest in cargoes of so-called clean petroleum products — such as gasoline, diesel and blending components — which went from 1.2 million to 2.3 million. Still, shipments of dirty products, including fuel oil, rose by more than half a million.

Longer Journeys

Companies in the European Union stepped back from Russian crude oil purchases shortly after the war began. The bloc imposed a crude embargo in December 2022 and followed it up with a prohibition on fuel imports two months later.

That’s forced Russia to send its oil on much longer journeys to buyers in China and India, making tanker safety in the Red Sea their problem too, in a way that it never has been before. Almost all of the crude shipped from Russia’s western ports needs to pass by the Red Sea coast of Yemen.

Russian vessels may not be directly at risk of attack from Houthi militants — after all, Russia and the Houthis are both being supported in their wars by Tehran. But that doesn’t rule out the risk of a ship carrying Russian oil being hit by mistake.

Most of the tankers carrying Russian crude are part of the huge shadow fleet of vessels that have been amassed to get around Western sanctions. The owners and insurers of those ships are often opaque, raising concerns about whether the tankers and their cargoes — including liabilities relating to any oil spills — are effectively uninsured.

Share this article in your social network