Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Canadians are making a variety of spending changes to offset the impact of higher prices

Article content

Good morning!

Advertisement 2

Story continues below

Article content

Article content

Canadians are making big changes to their holiday spending as they continue to feel the pinch of inflation on their finances, according to the latest Bank of Montreal Real Financial Index.

Nearly eight in 10 people are making a variety of spending changes to offset the impact of higher prices, including purchasing less expensive gifts (37 per cent), reducing big purchases (33 per cent), spreading purchases over several months (24 per cent) and trimming their list of gift recipients (28 per cent).

“The impact of inflation on Canadians’ finances is having a direct impact on how people shop this holiday season,” Gayle Ramsay, head of Everyday Banking at BMO, said in a press release.

More than four in 10 Canadians said they are either planning to modify or push back major purchases, including the 63 per cent who indicated they no longer plan to make large purchases such as buying a car or home this year.

Advertisement 3

Story continues below

Article content

“In addition to setting and following a holiday budget this year, it is crucial for Canadians to create a financial plan for 2023,” Ramsay said. “As we head into the new year, a key to alleviating financial anxiety will be learning how to protect financial progress you have made already, and how to continue making progress through a challenging economy.”

Younger Canadians (aged 18 to 34) are also changing the way they pay for this year’s holiday gifts, with generation Z and millennials being more likely to rely on their savings, debit cards and buy now, pay later programs.

“Given the highest inflation in four decades and the fastest interest rate increases in three decades, it’s not surprising that Canadian families, especially younger ones, are feeling substantial strain on their finances and well-being,” Sal Guatieri, senior economist at BMO, said in the release.

Advertisement 4

Story continues below

Article content

Along with changing the way they approach gift giving this holiday season, people are also making changes to their own wish lists.

A separate survey by personal finance comparison site Finder found that almost half of Canadians are listing cash at the top of their wish lists this year to help them pay for essential bills (20 per cent), build up savings (20 per cent) or build up an emergency fund (nine per cent).

“While many of us looked for ways to stretch a dollar, others found it impossible to trim the budget,” Romana King, senior finance editor at Finder, said in a press release. “It’s no surprise, then, that cash tops the list for most requested gift this holiday season.”

Overall, BMO said Canadians’ financial confidence has dropped, with only 69 per cent of adults feeling confident compared to 75 per cent last year.

Advertisement 5

Story continues below

Article content

More than eight in 10 Canadians indicated their financial situation is increasing their anxiety, with the most significant sources being housing costs (71 per cent), fear of unknown expenses (84 per cent) and family-related expenses (68 per cent).

However, there is a silver lining: “The relatively good news is that policy rates are expected to stabilize in 2023 as inflation slows, setting the stage for potentially lower borrowing costs in 2024,” Guatieri said.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

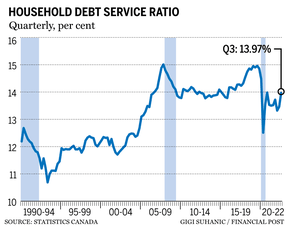

Consumer debt payments in Canada are significantly higher today than when interest rates were in the low teens in 1990, a sign of the economy’s “extreme level” of indebtedness, economist David Rosenberg said. The household debt service ratio, which plunged two years ago as rates fell and governments paid out COVID-19 aid, is rising again because of the Bank of Canada’s decision to sharply increase borrowing costs to cool inflation. “Think about that for a minute. Consumers are shelling out more in total debt-service payments out of after-tax income today at a 4.25 per cent BOC policy rate than they were three decades ago when the policy rate was 13 per cent,” Rosenberg said in a report to investors Wednesday. — Bloomberg

Advertisement 6

Story continues below

Article content

___________________________________________________

- Karina Gould, minister of families, children and social development, will announce child care fee reduction in Prince Edward Island

- Prime Minister Justin Trudeau meets with Quebec Premier Francois Legault

- Emergency Preparedness Minister Bill Blair will co-host the meeting of federal, provincial and territorial ministers for emergency management alongside Richard Mostyn, Yukon minister of community services and Doyle Piwniuk, Manitoba minister of transportation and infrastructure

- Today’s data: Canadian wholesale trade, international securities transactions; U.S. S&P global PMIs

- Earnings: Accenture PLC

___________________________________________________

Advertisement 7

Story continues below

Article content

_______________________________________________________

Advertisement 8

Story continues below

Article content

____________________________________________________

Over this past year, many young couples have been seeking ways to lower their expenses due to inflation eating into daily expenses, and the possibility of a recession just around the corner. Some millennials are saving money by postponing parenthood, which is estimated to cost between $10,000 to $15,000 a year in Canada. Our content partner MoneyWise Canada looks at why the cost of living has Canadians delaying parenthood and tips for how to afford it.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Advertisement

Story continues below