Article content

(Bloomberg) — AustralianSuper Pty’s latest rejection of the A$19.4 billion ($12.5 billion) bid for Origin Energy Ltd. signals more than a snub from the firm’s largest shareholder. It’s a clear display of the increasing clout of Australia’s giant pension funds.

While it’s too early to brand the A$3.5 trillion superannuation industry as activists, the largest player is showing rivals what’s possible — and more than likely — in the coming years. AustralianSuper’s rejection of a Brookfield Asset Management Inc.-led consortium’s revised bid for Origin on Thursday sent the energy firm’s shares tumbling almost 8% and the deal into disarray.

Article content

“This is a sea change event,” Alex Dunnin, head of investment research at Rainmaker Information, said in an interview. “This is super funds doing exactly what they’re meant to do, acting in the interests of their members to maximize members’ returns. And in doing that, as asset owners, they’re signaling to the whole economy that big super funds are a force to be reckoned with.”

AustralianSuper does have previous form. In 2018, it teamed up with local buyout firm BGH Capital against Brookfield in a bidding war for local hospital operator Healthscope, which the pension fund already owned part of. The teamwork paid off: Brookfield came back with a far higher price and a deal was eventually sealed in 2019.

Fast forward five years, during which time AustralianSuper has doubled its assets under management to A$300 billion, and is big enough to influence deals in its own right. The Brookfield-led bidders for Origin were forced to sweeten their offer on Thursday after AustralianSuper, with an about 13.7% stake, rejected their earlier bid. The fund took just hours to rebuff the revised offer.

Article content

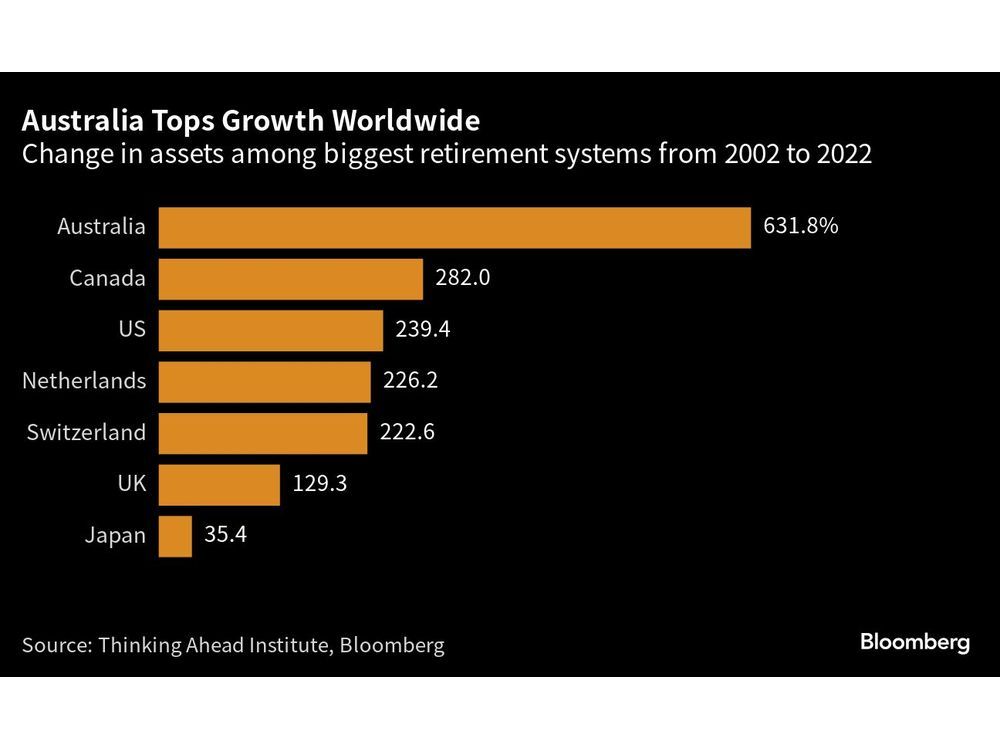

Australia’s pensions industry has grown into the world’s fourth-largest retirement savings pool, driven by decades of employers’ compulsory contributions on behalf of workers. The funds are piling into all sorts of assets as they pull in record inflows of about A$1 billion every week, and are increasingly investing money overseas as they outgrow their own backyard.

AustralianSuper has also stressed that Origin is a valuable asset for the energy transition, citing net zero targets as a compelling reason as to why the company is worth more. The pensions industry has been under mounting pressure over green commitments, especially as it continues to hold large stakes in big polluters. This week, the corporate regulator warned funds that they needed credible plans if they were making statements on targets.

“I daresay it’s not just about the raw financial return,” Dunnin said of the Origin rejection. “It’s superannuation meets the energy markets, meets capital markets, meets ESG requirements, meets the politics of business.”

Origin has said that it intends to proceed with a scheduled Nov. 23 vote on the deal. The process needs a majority of shareholders to participate and requires 75% of the participants to approve the takeover.

Share this article in your social network