Article content

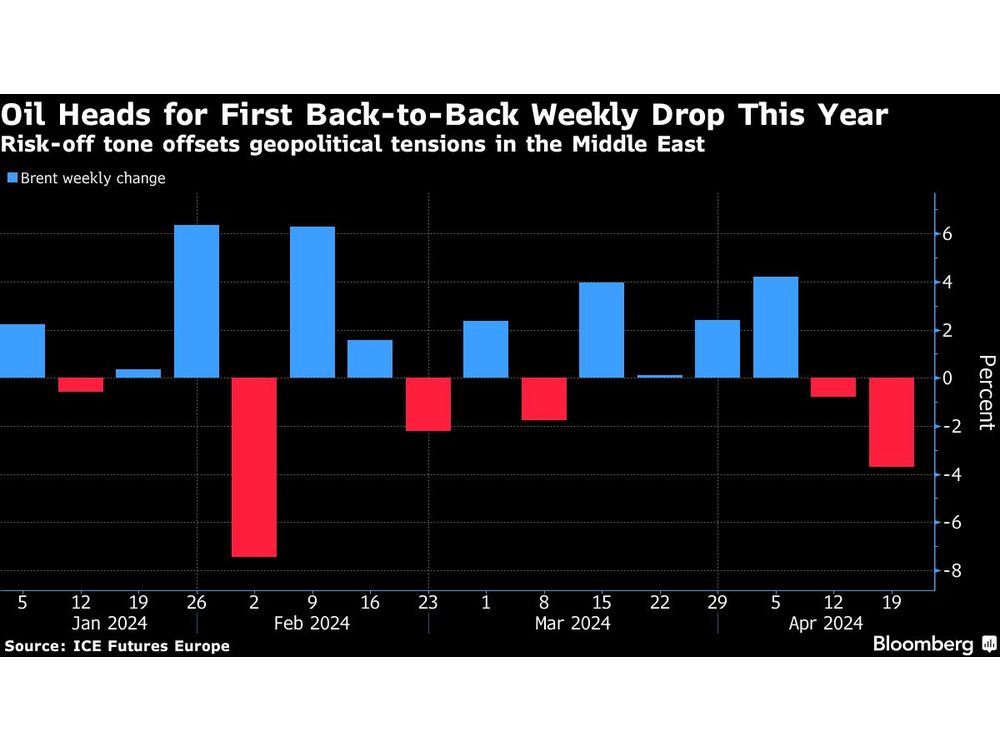

(Bloomberg) — Oil headed for its first back-to-back weekly drop this year as a wider risk-off mood driven by hawkish comments from Federal Reserve policymakers countered sustained tensions in the Middle East.

Brent traded near $87 a barrel after declining every session this week, despite Iran’s attack on Israel last weekend. West Texas Intermediate was above $82. Investors are increasingly concerned US interest rates will remain higher for longer, with Fed members signaling that a pivot toward looser policy remains some way off. That’s aided the dollar, a headwind for commodities.

Article content

In the Middle East — which accounts for about a third of global crude supply — rhetoric between Tehran and Israel has continued to escalate in the wake of Iran’s drone and missile strike. The Islamic Republic warned Israel this week against attacking its nuclear facilities, threatening to respond in kind if its atomic sites are targeted. The US, meanwhile, has urged restraint.

Crude remains higher in the year to date despite the recent decline, with gains driven by OPEC+ supply cuts, geopolitical risks in the Middle East and Russia, and lower shipments from Mexico. Nevertheless, some signs of weakness have started to emerge, with nationwide US oil stockpiles swelling to a 10-month high and a deterioration in the global diesel market.

“The Middle East war risk points to escalation, not de-escalation at present,” RBC Capital Markets LLC analysts including Helima Croft said in a note. With Israel expected to retaliate against Iran this coming weekend, “oil supplies could be caught in the cross-hairs of this metastasizing conflict,” they said.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network