Article content

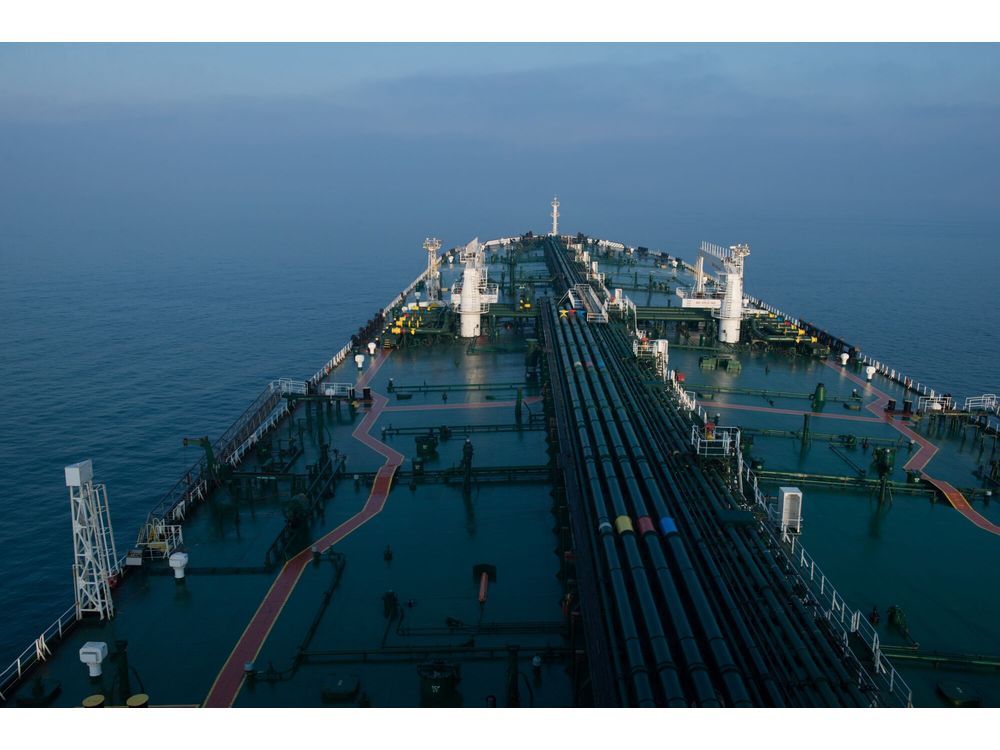

(Bloomberg) — Oil gained as Israel vowed to respond to an unprecedented attack by Iran, keeping tensions elevated in the Middle East.

Global benchmark Brent climbed toward $91 a barrel after a modest drop on Monday, while West Texas Intermediate was near $86. Top Israeli military officials said their country had no choice but to respond to Tehran’s weekend strike, even as European and US officials called for restraint.

Article content

Traders’ focus is now shifting to the nature and timing of the next Israeli move. Western and Arab nations are trying to convince Prime Minister Benjamin Netanyahu that an aggressive reaction to Iran’s assault would harm Israel’s interests. The Middle East accounts for about a third of global crude supply.

Oil has rallied this year, with OPEC+ supply cuts and elevated geopolitical risks in Russia and the Middle East helping to send prices higher. Demand has also been running at a good clip in leading economies, and there have been signs of strength in some product markets, including US gasoline.

Timespreads remain elevated, pointing to tight market conditions, while bullish call options — which profit from gains — are at a premium to opposing puts. Brent’s December-December spread — the gap between the contract for the final month of this year and next — has ballooned more than $6 a barrel in backwardation. That’s up from less than $3 in early January.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network