Article content

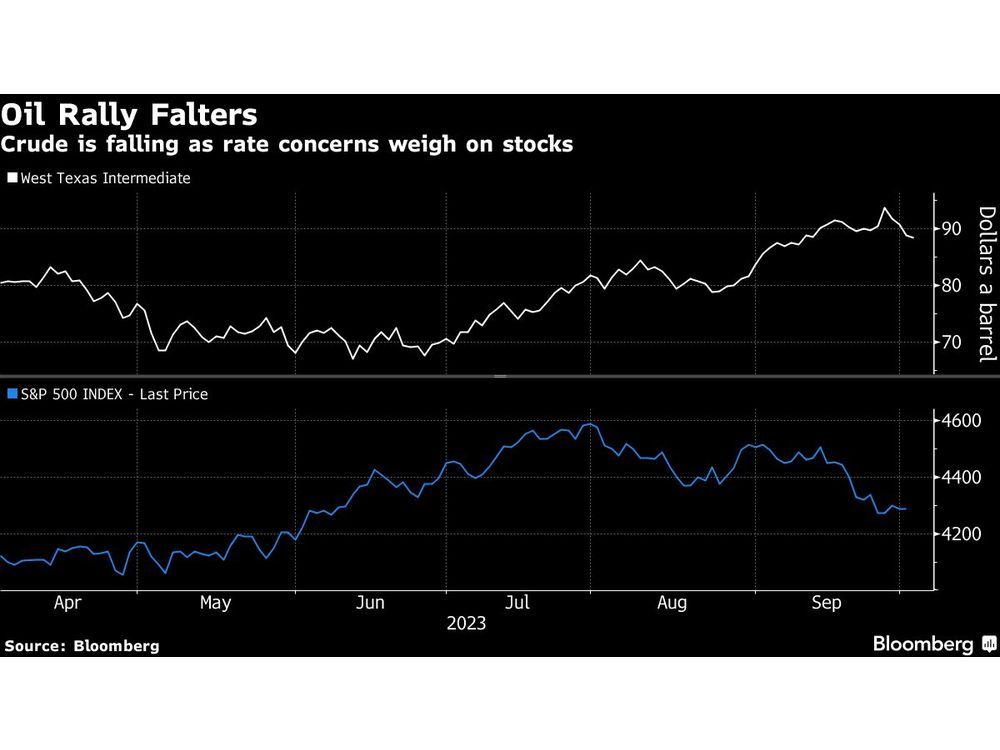

(Bloomberg) — Oil fell for a fourth day as macroeconomic concerns overshadowed physical market tightness to cloud the demand outlook.

West Texas Intermediate traded near $88 a barrel after declining by 2.2% in the previous session. A global rout in sovereign bonds and shares extended into Tuesday, while the dollar strengthened as traders digested messaging that the Federal Reserve will need to leave borrowing costs higher for longer.

Article content

WTI has now dropped around 6% since last Wednesday’s close on fears over the global economy, halting a rally that saw it surge by 29% last quarter on tight supply and had many analysts talking up the prospect of $100-a-barrel oil. Higher interest rates make it more expensive to store and ship crude and the strengthening dollar means it’s pricier for most buyers.

“Oil’s downward move has very little to do with fundamentals and all to do with rising Treasury yields and the stronger US dollar,” said Warren Patterson, head of commodities strategy at ING Groep NV. “I still think oil has some room to move higher. Fundamentally, it is looking constructive.”

Futures curves are still indicating near-term supply scarcity, but they’ve eased from last week. WTI’s prompt spread is $1.65 a barrel in the bullish backwardation structure, down from as much as $2.60 on Thursday.

The Organization of Petroleum Exporting Countries kept production steady last month as the group and its allies continued a squeeze on supply. The OPEC+ alliance is due to meet online for a review of global markets on Wednesday, but is showing no sign of relaxing its grip.

Article content

Tight supply has seen stockpiles plummet at the key US hub in Cushing, Oklahoma. Traders will be looking to the industry-funded American Petroleum Institute for estimates for last week later on Tuesday, before official data is released on Wednesday.

The lack of supply is being partially offset by rising production in the US. Turkey, meanwhile, said a key oil pipeline from northern Iraq to the Mediterranean could resume this week, which may put more downward pressure on oil, although an Iraqi official cast doubt on that timetable.

Citigroup Inc. forecast Brent will fall to the low $70s per barrel next year as the market swings back to surplus. Demand looks constrained and there’s more oil coming into the market from non-OPEC+ suppliers, it said in a note.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network