Article content

(Bloomberg) — Oil declined as weak Chinese data raised concerns about demand, and traders looked ahead to an OPEC+ meeting on supply policy.

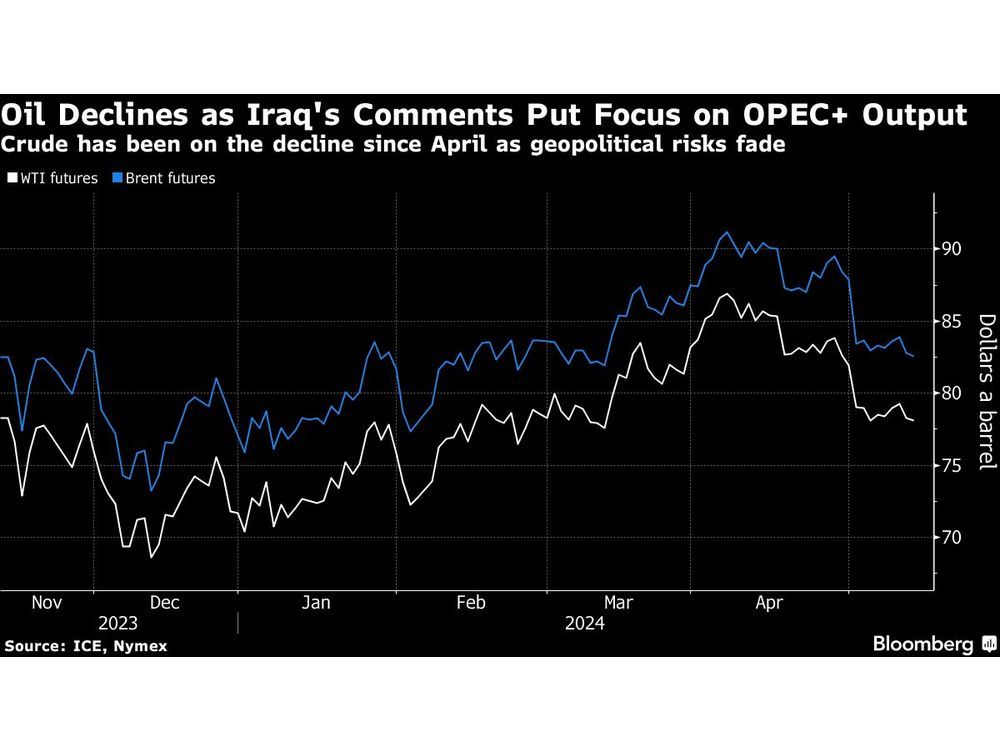

Brent fell toward $82 a barrel after losing 1.3% on Friday, while West Texas Intermediate was below $78. Poor Chinese credit and inflation data showed the government is struggling to boost demand in the world’s biggest oil importer. That weighed on risk assets including shares and some commodities.

Article content

On the supply front, meanwhile, Iraqi Oil Minister Hayyan Abdul Ghani initially said at the weekend that Baghdad had cut production enough and wouldn’t agree to more. But later, he said that any decision was a matter for OPEC, and it would stick to whatever the group decided. OPEC+ meets June 1.

Crude has been on a downward arc since mid-April, with prices giving up most of the risk premium triggered by tensions in the Middle East, and they’ve also been pressured by a mixed demand outlook. Timespreads — one of the market’s most closely tracked metrics — suggest conditions are becoming less tight.

“I do expect crude to remain under some downward pressure, as the Gaza-related geopolitical risk premium continues to fade,” said Vandana Hari, founder of Vanda Insights. Iraq’s comments on OPEC+ supply were a “storm in a teacup,” she said.

Iraq, the second-biggest producer among OPEC members, has been the source of some unease in the group as it’s failed to fully implement existing reductions. Still, most market watchers expect the wider OPEC+ group will extend curbs into the second half even as collective spare capacity expands.

The Organization of the Petroleum Exporting Countries is due to deliver its market outlook on Tuesday, offering clues on global balances, the outlook for demand, as well as supply dynamics. A report from the International Energy Agency is also due this week.

Brent prompt spread — the difference between its two nearest contracts — has narrowed to 44 cents a barrel in backwardation, compared with a gap of $1.20 two weeks ago.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network