Article content

(Bloomberg) — Chancellor of the Exchequer Jeremy Hunt told UK cabinet colleagues that getting inflation below 5% this year will be difficult, insisting the government has to hold the line on fiscal discipline at his budget in March.

(Bloomberg) — Chancellor of the Exchequer Jeremy Hunt told UK cabinet colleagues that getting inflation below 5% this year will be difficult, insisting the government has to hold the line on fiscal discipline at his budget in March.

(Bloomberg) — Chancellor of the Exchequer Jeremy Hunt told UK cabinet colleagues that getting inflation below 5% this year will be difficult, insisting the government has to hold the line on fiscal discipline at his budget in March.

Story continues below

Hunt delivered the verdict in a private briefing during a cabinet away-day at Prime Minister Rishi Sunak’s Chequers country residence on Thursday, according to people present who asked not to be named discussing internal Treasury assessments.

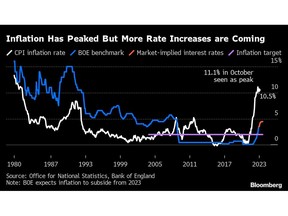

The chancellor presented a mixed forecast, telling fellow ministers that the green shoots of recovery are beginning to show, with inflation past its peak and falling quicker than expected so far, the people said. But he also warned of stubborn price rises for food, goods and services, making it tough to get overall inflation down below 5%, they said.

The remarks cast doubt on the forecast in November by the government’s fiscal watchdog, the Office for Budget Responsibility, for inflation to fall to 3.8% by year-end, from double digits last year. They may also damp hopes that the Bank of England will soon finish the quickest cycle of interest rate increases in three decades. Investors have started to price in the prospect of a rate cut later this year after inflation fell in each of the past two months.

Story continues below

Sunak has made halving inflation one of five key pledges that voters should measure him against — a target that remains possible even with inflation above 5%, given that it peaked at a high of 11.1% in 2022.

Nevertheless, Hunt warned that the government could not afford to deviate from its task of curbing inflation, expressing his frustration at calls from some right-wing Tory backbenchers for immediate tax cuts to drive growth, the people said.

No ‘Headroom’

In a Bloomberg TV interview on Friday, he said “at the moment, we don’t have the headroom for major cuts.”

The UK’s Consumer Prices Index soared to 11.1% in October spurred on by natural gas and electricity costs that jumped following Russia’s invasion of Ukraine. The pace slowed to 10.5% in December and is expected to come down sharply this year.

Story continues below

Hunt said that’s largely thanks to lower-than-feared energy prices, which will help push inflation down to 6% to 7%, the people said. But he also cautioned that higher prices risk becoming entrenched in areas including food, describing this as the main risk to the economy.

Hunt described what he called stickiness in wage inflation as the primary problem, as well as the tight labor market and economic inactivity, which will be addressed with policy announcements in the budget on March 15.

Wage growth had been higher than expected, he said, telling ministers negotiating pay deals with striking trade unions that they cannot offer inflation-busting pay rises.

BoE Governor Andrew Bailey has also warned of the risks of inflation becoming embedded in the economy as workers demand higher pay to make up for soaring living costs.

—With assistance from Reed Landberg and Anna Edwards.