Article content

(Bloomberg) — Halliburton Co. joined rival SLB in boosting its quarterly dividend as the world’s biggest oilfield contractors gear up for an international boom amid slowing shale work.

The top provider of fracking services will lift its payout by 6% to 17 cents a share, the highest since the onset of the pandemic, after posting fourth-quarter earnings that beat expectations. Halliburton generated $1.1 billion in free cash flow, its best quarter in more than two decades.

Article content

“The outlook for oilfield services demand remains strong,” Chief Executive Officer Jeff Miller said Tuesday in a statement. “We will deepen and strengthen our value proposition, and generate significant free cash flow.”

Shares rose 2% in premarket trading in New York.

Halliburton, with its unrivaled footprint in all of the major shale basins, offers the closest proxy to US producer activity. The Houston-based company’s dividend boost comes after SLB, the world’s biggest oilfield services provider, announced a 10% hike to its payout last week on the expected growth in offshore markets in the coming years.

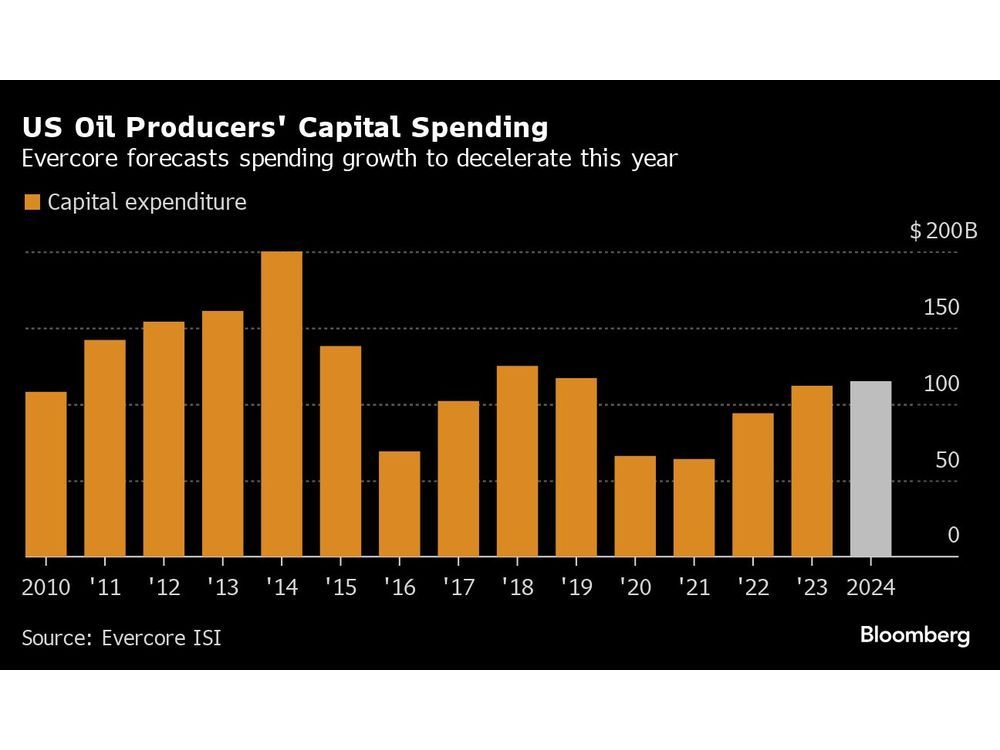

The top oilfield contractors are looking to make up for a slowdown in US shale work by boosting activity overseas. Capital spending by explorers in the US is expected to increase 2% this year, far less than last year’s 19% expansion, according to Evercore ISI.

After posting surprising output growth in 2023, US producers are downshifting expansion plans in order to make their inventory last longer and continue returning profits to shareholders. As a result, Halliburton is expected to post little change in sales in the US and Canada this year, while the rest of its business increases 12%, according to data compiled by Bloomberg.

Baker Hughes Co. will round out the Big 3 later Tuesday when it reports fourth-quarter results.

(Updates with free cash flow comparison in second paragraph.)

Share this article in your social network