Article content

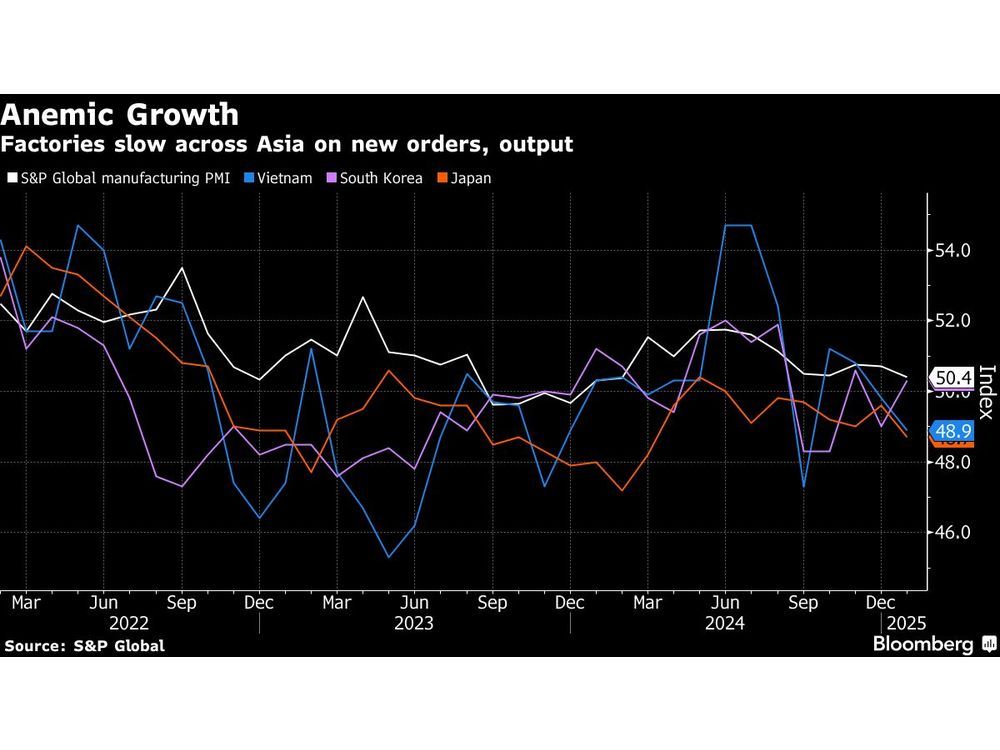

(Bloomberg) — Factories across Asia expanded at a lackluster pace in January as demand cooled, ahead of a trade war that President Donald Trump kicked off on the weekend.

Article content

The PMI gauge for manufacturing-heavy countries showed tepid activity, according to the S&P Global purchasing managers index that provides a snapshot of the region. In Vietnam, the index contracted further to 48.9 as output fell for the first time in four months, and in South Korea, activity improved slightly to 50.3, just above the 50-mark indicating expansion.

Article content

Across Southeast Asia, activity fell to an 11-month low of 50.4. Five major economies including Japan showed a deterioration overall while South Korea, Indonesia and Malaysia showed slight improvement.

Manufacturing growth eased in China to the weakest in four months and below economists’ expectations.

The biggest drags on activity across many countries were output and new orders. In a sign of weakening demand from abroad, export orders fell for the third month in a row in Vietnam, demand eased in Taiwan and contracted for an eighth month in Japan. Export orders rose slightly in South Korea.

Purchases of inputs slowed to a three-month low and confidence remained subdued across Southeast Asia, S&P said.

“New orders and output both expanded at a softer pace, and the export market continued to hold back overall sales growth,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a statement Monday.

The latest figures show the state of trade across the region before Trump announced tariffs over the weekend on America’s three largest trading partners China, Mexico and Canada. The levies are set to upend trade globally, though could also shift demand for production to many countries across Asia as firms seek to avoid tariffs.

Article content

Trump also said that levies are coming soon for the European Union, signaling an expansion of the trade battle.

The region faces mounting challenges in the year ahead. Slowing economic growth in China, Europe and the US has reduced demand for exports, including chips and technological goods that Taiwan and South Korea specialize in making.

Protectionism globally is also a growing risk. While Trump has avoided issuing tariffs or threats of levies against most countries in the region — with China being a major exception — his administration has made trade deficits a major focus. The impact of levies on China are also set to dent activity in the world’s second-largest economy, with spillovers across the region.

Share this article in your social network