Article content

(Bloomberg) — European Central Bank Governing Council member Mario Centeno said he’s confident inflation has peaked and is quickly receding, and suggested underlying price growth will follow with a lag.

Article content

Interviewed on Bloomberg Television in the French city of Aix-en-Provence on Sunday, the Bank of Portugal governor suggested that colleagues shouldn’t doubt that their monetary policy is working.

Article content

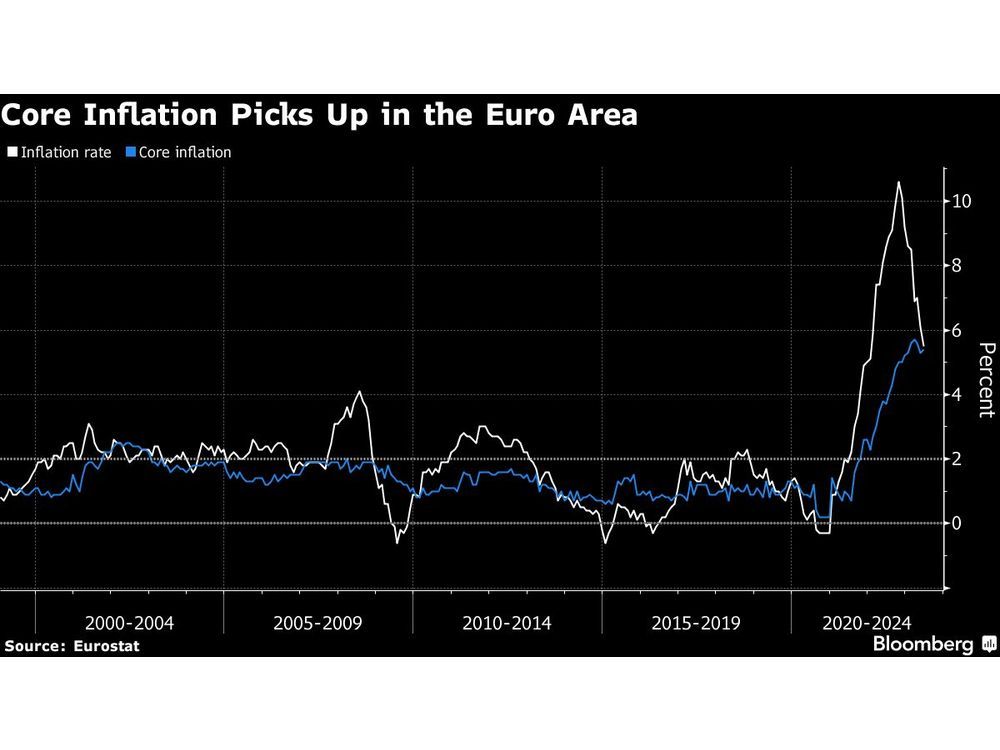

“Core inflation stands out as a very important indicator,” he said. “It’s not coming down as fast as headline inflation, but we also need to remember that in the way up it played exactly the same trajectory. So we need to remain confident too in the way we are fighting inflation.”

The remarks by one of the more dovish ECB officials highlights how the path of underlying price growth, which strips out volatile elements such as energy and food, is central to the debate on how far interest rates should still rise. Policymakers have flagged a hike for later this month, with no clear commitment thereafter.

Article content

His assessment follows that of his more hawkish colleague, Vice President Luis de Guindos, who said on Friday that most indicators of so-called core inflation “have started to show some signs of softening.”

That gauge accelerated in June to 5.4%, while headline price growth slowed noticeably to 5.5%. Centeno was adamant that inflation is on the way down.

“All indicators say so,” he said. “Of course for this to happen, we need to keep our monetary policy very clear.”

Centeno predicted that inflation will be “well below 3%” by the end of this year. That’s much closer to the 2% level that the ECB aims for.

“We target headline inflation, that’s very important,” he said. “And headline inflation is coming down, actually it’s coming down faster than the way up.”

Meanwhile growth itself is weakening too, he observed, citing indexes of purchasing managers and business confidence.

“PMI, IFO numbers for Germany were not very good,” he said. “The economy is slowing down, inflation is coming down.”