Article content

(Bloomberg) — Shares of data center operator DigiCo Infrastructure REIT are set to start trading in Sydney on Friday after a A$2 billion ($1.3 billion) initial public offering that was Australia’s biggest in more than six years.

Article content

The deal — Australia’s largest since oil refiner Viva Energy Group Ltd.’s listing in July 2018 — has helped boost the nation’s overall IPO proceeds for this year to $2.4 billion, more than the amount raised in 2022 and 2023 combined, according to data compiled by Bloomberg.

Article content

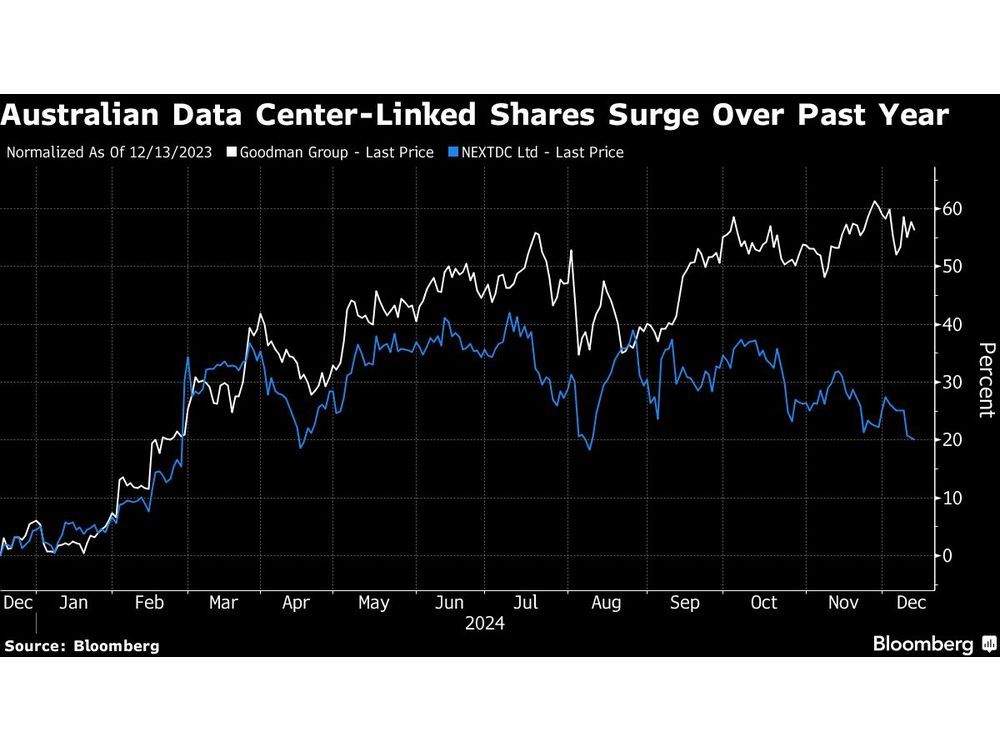

DigiCo REIT is seeking to capitalize on the surge in investor interest in the sector, with a slate of companies seeking cash to expand their data center portfolios on the back of the artificial intelligence boom. Global demand for such infrastructure is expected to rise at an annual rate of 19% to 22% from 2023 to 2030, according to a recent McKinsey & Co. report.

“DigiCo breathes a little life back into the market and may augur a reawakening in the year to come,” Morningstar Inc. market strategist Lochlan Halloway wrote in a Dec. 5 note.

High interest rates, inflationary concerns and weak commodity prices have dented IPO activity in Australia in recent years. The DigiCo IPO was met with “significant demand from institutional cornerstone and retail investors,” according to a Nov. 21 exchange filing.

The offering also comes on the heels of a massive data center transaction in Australia this year. Blackstone Inc. and the Canada Pension Plan Investment Board agreed in September to acquire AirTrunk in a deal valuing the company at A$24 billion. That was Blackstone’s largest-ever investment in the Asia Pacific region.

Article content

DigiCo is expected to have a total portfolio of 13 properties in Australian and North American markets. It currently holds three properties, according to its prospectus.

Subscribe to The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you listen.

Despite the growing appetite for data centers, Morningstar sees DigiCo REIT’s stock as overpriced. It values the stock at A$3.40 per share, a 32% discount to its A$5 offer price.

The “vendors are asking investors to stump up too much,” Halloway wrote. Still, the stock may rise in its debut as “data centers are a hot theme, the deal is oversubscribed and there has been a dearth of new opportunities for investors this year.”

Alternative asset manager HMC Capital Ltd., led by former UBS Group AG dealmaker David Di Pilla, is launching the listing. The Sydney-based company will hold about an 18% stake in DigiCo REIT following the IPO.

—With assistance from Adam Haigh.

Share this article in your social network