Article content

(Bloomberg) — Chilean miner Antofagasta Plc and Chinese smelter Jinchuan Group agreed to copper-concentrate supply contracts for 2024 that set processing charges 9% lower than this year, as the supply of mined ore tightens and refining capacity expands.

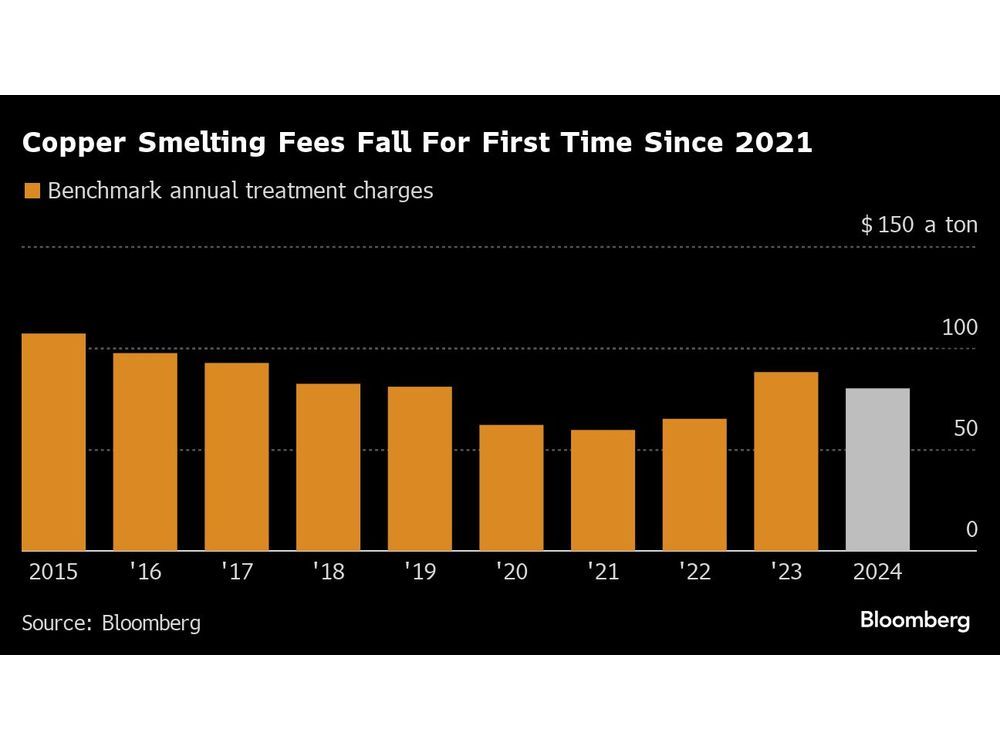

Smelter fees, known as treatment and refining charges, were set at $80 per ton and 8 cents per pound, according to people familiar with the matter who asked not to be named because the details aren’t public. That compared with a six-year high of $88 per ton and 8.8 cents per pound for 2023, and is the first decline in fees in three years.

Article content

The deal is one of the key annual negotiations in the global copper industry, setting the price for millions of tons of copper ore shipments. The first settlement between large mining and smelting companies traditionally serves as a benchmark for the rest of the industry.

The deal covers 50% of the volumes Antofagasta supplies to Jinchuan, since the Chilean miner typically sells the other half of its output at prices set mid-year, one of the sources said. It wasn’t immediately clear whether other Chinese smelters would follow the deal.

Calls to Jinchuan for comment were not answered outside of normal business hours. Spokespeople for Antofagasta did not immediately respond to an email seeking comment.

Chinese smelters have been racing to secure supply in recent weeks, creating a tense environment at the negotiations that took place in Shanghai in the past few days. Smelters are a vital cog in the supply chain, converting concentrated ore into metal that’s used in everything from home wiring to solar equipment, with China having the biggest processing industry by far.

Article content

The drop in fees indicates the market for copper ore, known as concentrate, is tightening, driven by a massive expansion of processing capacity in China as well as concerns over the future of a key mine in Panama.

Read More: Copper Bulls in Retreat, But One Part of Market Is Heating Up

The tighter copper concentrate market doesn’t automatically imply a tighter market for copper metal, since expanding copper smelters would produce more metal, potentially weighing on prices. But over time, the lower processing fees could force some smelters out of business, ultimately hitting the copper metal market just as many observers anticipate a rapid increase in demand due to the energy transition.

“A full gamut of unprecedented copper smelter expansion globally is underway and a major concentrates deficit looms,” said Dimitri Lemos, a copper trader at Open Mineral AG. “The viability of some older smelters however may be in doubt.”

(Adds negotiations, trader comment from paragraph six)

Share this article in your social network