Article content

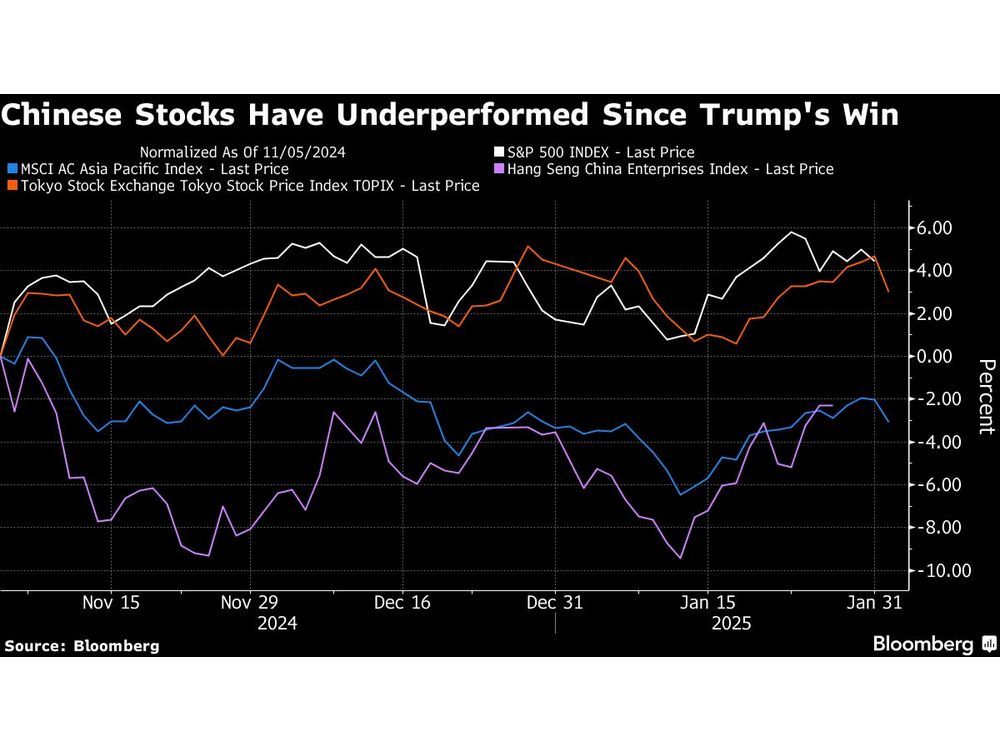

(Bloomberg) — Chinese equities listed in Hong Kong fell as trading resumed after the Lunar New Year holiday, with traders weighing US President Donald Trump’s move to impose a 10% levy on China.

Article content

The Hang Seng China Enterprises Index dropped as much as 2.2% in early trading, in line with declines across the region. Hong Kong’s stock market has been shut since midday Jan. 28 while equities on the mainland will start trading again on Feb. 5.

Article content

Trump’s tariffs are adding to the headwinds buffeting Chinese shares as weak consumption and a long-running real estate slump keep investors on the sidelines. Traders are looking to an annual legislative meeting in March for further stimulus to revive a market that has lost around half the gains it posted following a policy blitz unveiled in September.

“Historically speaking, the Hong Kong market is usually weak after Chinese New Year and the market is still digesting Trump’s tariff escalation,” said Billy Leung, an investment strategist at Global X ETFs. “As for the tariffs’ fundamental impact, the 10% was already better than expected so the risk is toward less severe risks and we are probably looking more toward Chinese actions which have been rather mild.”

Trump imposed tariffs of 25% on Canada and Mexico and 10% on China on Saturday, with the levies set to come into effect Tuesday. While Canada and Mexico have vowed to hit back, China’s Commerce Ministry said it would initiate “corresponding countermeasures” without elaborating, and pledged to file a complaint at the World Trade Organization.

Article content

The latest tariff announcement from Washington also weighed on other Chinese assets, with the offshore yuan sliding as much as 0.7% on Monday to approach a record low versus the dollar.

China’s onshore benchmark CSI 300 Index retreated 3% in January after posting back-to-back monthly gains, as investors sought more aggressive measures from authorities to reinvigorate the market. Analysts say Beijing’s efforts — including plans to stabilize the stock market by increasing pension investments and subsidizing consumer products — fail to address the weakness in consumption that’s weighing on the economy.

—With assistance from Iris Ouyang.

Share this article in your social network