Article content

(Bloomberg) — Bank of Japan Governor Kazuo Ueda fired a clear warning shot to financial markets about a potential policy move as he beefed up his language on the weak yen a day after meeting with Prime Minister Fumio Kishida.

“Foreign exchange rates make a significant impact on the economy and inflation,” Ueda said in response to questions in parliament Wednesday. “Depending on those moves, a monetary policy response might be needed.”

Article content

Ueda also said it’s important to be mindful of the fact that the weak yen’s likelihood of having an impact on inflation is more than before as Japanese companies become increasingly willing to pass on rising costs to customers via price hikes.

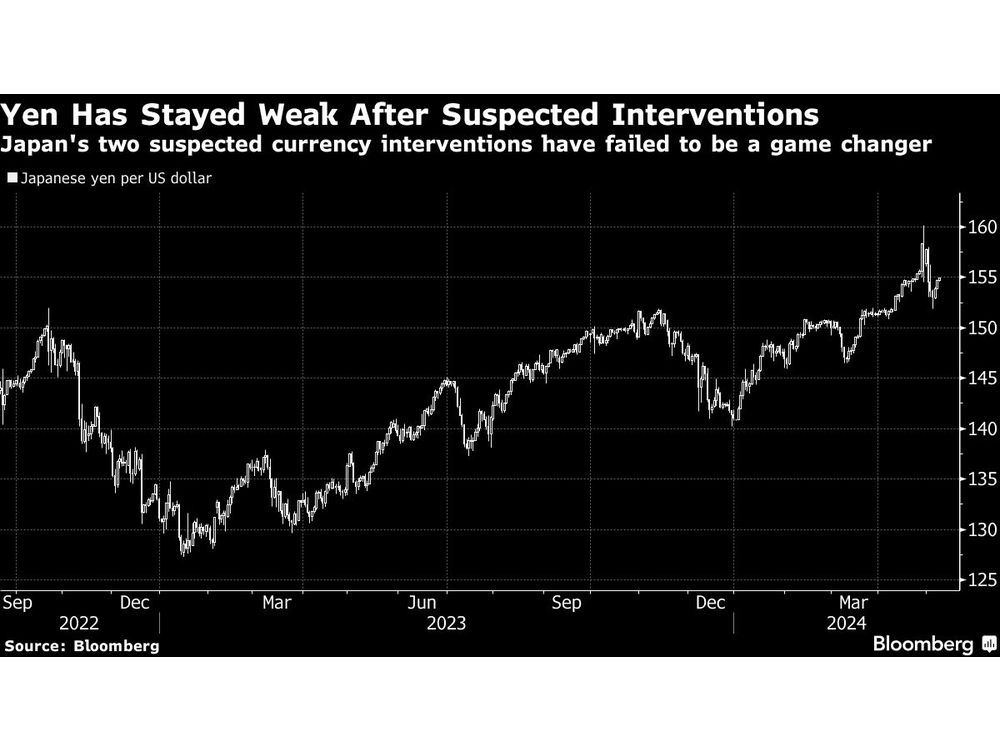

The yen slid to an intraday low Wednesday of 155.27 to the dollar not long after Ueda spoke, underscoring the possibility that authorities may have to act sooner to prevent the impact of last week’s suspected intervention from unraveling.

The governor appears to have adjusted the tone of his remarks on the yen after comments he made last month were deemed soft enough that currency traders continued to sell Japan’s currency, which at one point weakened beyond 160 per dollar for the first time in 34 years.

Ueda made similar warning comments after meeting with Prime Minister Fumio Kishida late Tuesday, nurturing market speculation of potential action at coming policy meetings.

Japanese Minister of Finance Shunichi Suzuki made similar remarks while appearing in the same parliament session, saying, “While the weak yen has plusses and minuses, right now I have strong concerns about the minus side with the upward pressure on import prices.”

Article content

Suzuki added that dealing with soaring prices “is extremely important as a major policy issue” for officials.

“Since Japan relies on overseas markets for food and energy, and a large portion of its transactions are denominated in dollars, a weaker yen could raise prices of imported goods,” Suzuki said.

The concerted effort by top financial authorities comes as the government is suspected of having intervened in the market twice last week to support the yen, action that came after Ueda refrained from sending strong hints of concerns about the yen at a post-meeting press briefing on April 26.

Read more: Japan Likely Spent About $23 Billion in Latest Yen Intervention

Ueda’s dialogue Tuesday with Kishida took place only seven weeks after a discussion they held on March 19, an unusual degree of frequency that underscores growing concerns among the nation’s leaders.

With the yen having mostly shrugged off last week’s suspected intervention, some BOJ watchers see the ball moving to the BOJ’s court. Having raised interest rates for the first time since 2007 in March, the BOJ faces a more difficult decision on any follow-up hike, given the anemic state of Japan’s economic recovery.

“The Bank of Japan is closely monitoring recent weak yen for the conduct of policy,” Ueda said.

(Adds market moves)

Share this article in your social network