Lunaz, the electric vehicle company backed by David Beckham, has undergone substantial job losses after entering administration, marking a significant setback for the Silverstone-based enterprise.

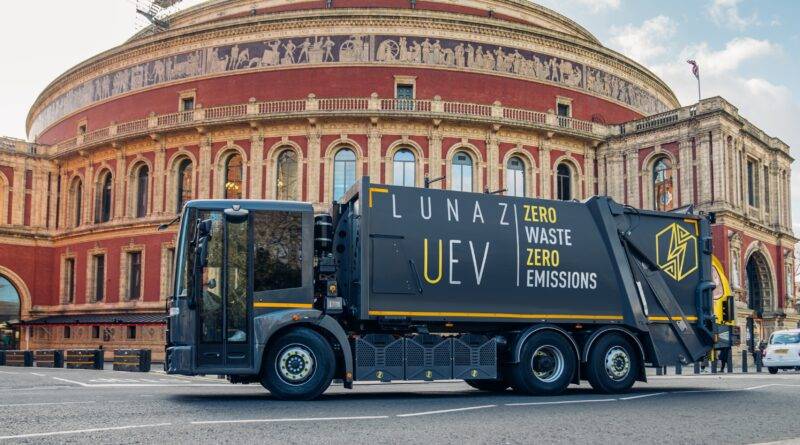

Administrators from FRP were recently appointed to oversee the operations of Lunaz Group, which included Lunaz and App Tech Productions, specializing in the electrification and upcycling of classic cars and commercial vehicles, including refuse lorries.

In a joint statement, administrators Sarah Cook and Miles Needham lamented the situation: “Lunaz Group had developed a forward-looking product, designed to support the circular economy and give new leases of life to both heritage and working commercial vehicles. Unfortunately, the recent extension to the deadline for the transition to zero-emissions vehicles led to a slowdown in sales and the decision to appoint administrators to the group. Regrettably, this impacts the employees who we will continue to support through their redundancy claims in the coming weeks.”

Earlier, Lunaz attributed its decision to enter administration to the delay in the planned ban on the sale of petrol and diesel vehicles. Prime Minister Rishi Sunak had announced last year a postponement of the ban by five years, shifting it from 2030 to 2035.

According to filings with Companies House, David Beckham holds 200,000 shares in Lunaz Group, while founder and CEO David Lorenz owns 600,000 shares. Other shareholders include OPI Investments, Serum Life Sciences, Glasgow Investments, Blue Endeavor Ventures, Progressive Media Investments, and PG Ventures Investments.

Despite being valued at up to $200 million following a funding round in 2022, Lunaz has encountered significant challenges amidst the evolving landscape of electric vehicle adoption and regulatory frameworks. The company’s fate underscores the complexities and uncertainties facing businesses in the transition towards sustainable transportation solutions.