Article content

(Bloomberg) — Australia commanded a premium for its first sovereign green bond, as investors were drawn by the nation’s credible framework and plan to issue more debt.

The nation attracted more than three times the A$7 billion ($4.7 billion) worth of debt maturing in June 2034 at the final clearing price, the Australian Office of Financial Management said Tuesday. The average yield is 4.295%, about 1.5 basis points below the nation’s benchmark May 2034 bond, according to Bloomberg calculations, indicating investors were willing to pay a premium to hold green debt.

Article content

Demand for the issuance was likely driven by Australia’s ambitions and “a relatively scarce pool of green Australian assets,” said Robert Thompson, a macro rates strategist at RBC Capital Markets in Sydney. “Not to mention the increasing of importance of ESG considerations on the investor side, whether specific mandates are strict or not.”

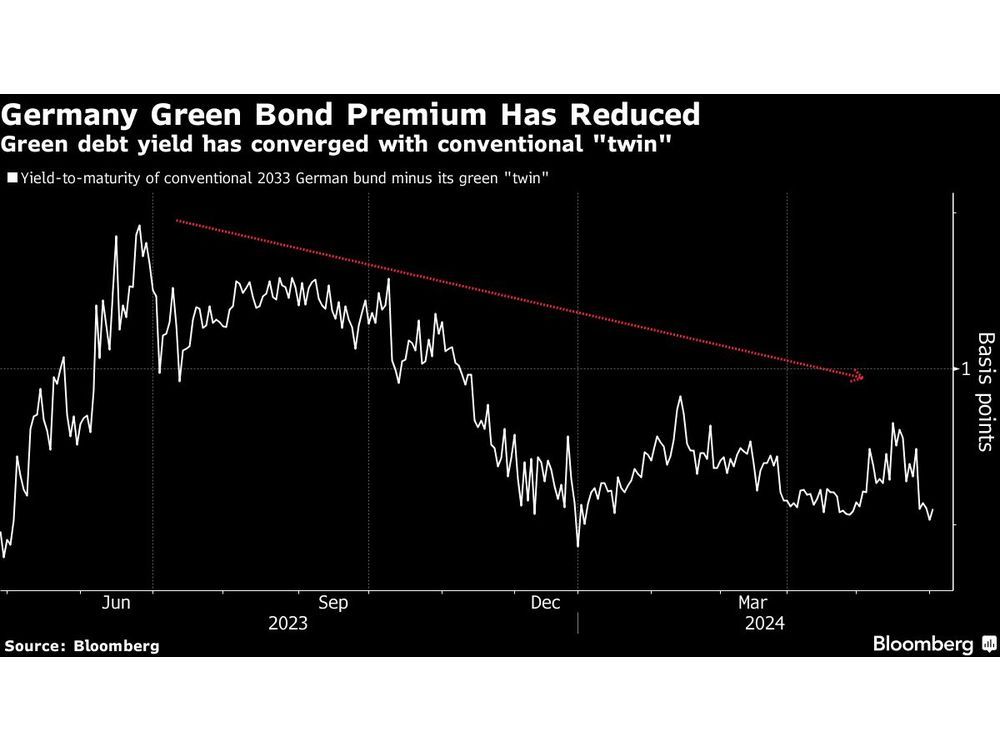

The issuance comes as governments and corporates flock to sustainable finance markets this year in a bid for cheaper funding costs, making substantial premiums some pay to hold green debt rare. The greenium on Germany’s 10-year bond has narrowed, while India didn’t accept any bids for its 2034 green bond at auction last week.

It’s an opportune time for Australia, which has said it will issue more green debt with different maturities in the future. The yield on Australia’s benchmark 10-year note has jumped more than 65 basis points the past year, the third most in the developed world, according to data compiled by Bloomberg.

Proceeds of Australia’s green bonds will be used to accelerate the nation’s energy transition including hydro-power and marine renewable energy, and excludes nuclear power, according to the government’s green bond framework. The outline is “credible, impactful” and aligns with international norms, according to a second party opinion from Systainalytics.

Article content

Still, Australia remains among the highest per-capita carbon emitters in the world and intends to develop new natural gas fields to meet its net zero target. Australia’s emission reduction policies and national targets are “insufficient” in meeting its Paris Agreement obligations, according to Climate Action Tracker.

While Australia needs to implement more initiatives, “it is a step in the right direction,” said James Wilson, a senior portfolio manager at Jamieson Coote Bonds Pty Ltd., who participated in the deal. “It is an example of the government channeling their full efforts toward making the transition a success, and we expect this bond to be well sought after and trade with a greenium.”

Share this article in your social network