Article content

(Bloomberg) — Stocks in Asia are broadly set to track gains in Europe, where the likelihood of greater military spending lifted shares in defense companies and bond yields.

Stocks in Asia are broadly set to track gains in Europe, where the likelihood of greater military spending lifted shares in defense companies and bond yields.

(Bloomberg) — Stocks in Asia are broadly set to track gains in Europe, where the likelihood of greater military spending lifted shares in defense companies and bond yields.

Article content

Article content

Shares were little changed in early trading in Sydney, while futures pointed to a gain in Hong Kong, a flat open in Tokyo and an advance in US benchmarks after a holiday on Monday. Europe’s Stoxx 600 index rose 0.5% and 10-year bund yields — the benchmark borrowing rate for the euro area — reached the highest in more than two weeks.

Advertisement 2

Story continues below

Article content

The US asked European nations to spell out what security guarantees and equipment they can offer Ukraine to ensure a lasting peace settlement. European officials say they are working on a major package to ramp up defense spending and some EU leaders are meeting in Paris to draw up their response.

“The goalposts are shifting, and the EU is realizing they can rely less and less on the US for protecting their borders. In lockstep, we’re going to have to see European countries spend more on defense,” said Aneeka Gupta, head of macro research at Wisdomtree UK Ltd. “That does warrant a bit more caution on bonds.”

The developments have cemented the view that debt sales will need to increase as European nations shoulder the cost of a lasting peace deal between Ukraine and Russia. Upgrading defense and protecting Ukraine may cost Europe’s major powers an additional $3.1 trillion over 10 years, according to Bloomberg Economics estimates.

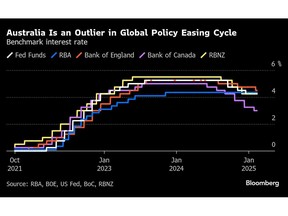

In Asia, the Australian dollar held near a two-month high before a central bank meeting that’s expected to see the first rate cut in four years. The Aussie’s gain came as a gauge of dollar strength declined for a third day. Meanwhile, BHP Group Ltd.’s first-half profit slumped 23% in results released early Tuesday, as the world’s biggest public miner said it was impacted by falling Chinese demand for key commodities including iron ore and copper.

Article content

Advertisement 3

Story continues below

Article content

The Reserve Bank of Australia is widely expected to embark on easing on Tuesday, with its first rate cut since November 2020. However, a strong labor market, resilient consumer spending, robust credit growth and a weaker currency could make the case for a hold, said Bloomberg Economics economist James McIntyre.

Also in Asia, optimism around a revival in China’s economy was boosted Monday after a meeting between President Xi Jinping and business figures including Alibaba Group Holding Ltd. co-founder Jack Ma raised hopes that a years-long crackdown on the private sector is ending.

In the US, Federal Reserve Governor Christopher Waller said recent economic data support keeping interest rates on hold, but if inflation behaves as it did in 2024, policymakers can get back to cutting “at some point this year.”

Some of the key events this week:

Advertisement 4

Story continues below

Article content

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Sujata Rao.

Article content

Comments