Article content

(Bloomberg) — Shares in Asia are primed for declines Thursday after a selloff in US stocks and bonds following hawkish comments in minutes of the Federal Reserve’s last meeting.

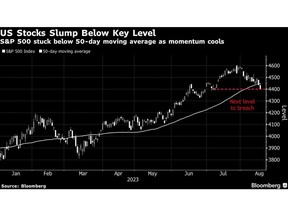

Equity futures for benchmarks in Japan, Australia and Hong Kong all declined. The S&P 500 fell 0.8% Wednesday while the Nasdaq 100 dropped 1.1%, with heavyweights Meta Platforms Inc, Amazon.com Inc. and Tesla Inc, down more than 1.5%. US futures were little changed in early Asian trading.

Article content

The 10-year Treasury yield touched fresh intraday highs not seen since October, while yields on the policy-sensitive two-year notes inched higher to near 5%. The selling erased gains for the year for an index of US government debt.

Those moves followed minutes from the Fed’s July meeting that fanned concerns the central bank would continue to raise interest rates to quell inflation.

“The Fed has no choice but to keep it up until they are convinced that inflationary expectations are quashed,” Steve Sosnick, chief strategist at Interactive Brokers, said after the minutes were released. “Doing otherwise risks some of the embers reigniting. Even though two governors favored keeping rates steady in July, it is important to keep in mind that a pause is not a pivot.”

The Bloomberg dollar index rose to a two-month high and the pound also strengthened following higher-than-expected UK inflation data.

Australian and New Zealand bond yields rose in early Thursday trade. Australian jobs data due later is expected to show slowing in new hires and an increase in the unemployment rate.

Article content

The yen slumped to a 2023 low and traded at levels that previously that triggered Japan’s intervention in September, while the offshore yuan weakened against the backdrop of financial and economic concerns.

One of China’s biggest shadow banks skipped payments on several investment products, sparking rare protests in Beijing. The company offers high-yielding trust products linked to the country’s embattled real estate market. Revenue from Tencent Holdings Ltd. disappointed in a warning for the country’s tech sector, and a unit of China Evergrande Group said the Chinese securities regulator has built a case against it relating to suspected information disclosure violations.

Those worries come as China’s central bank moved to boost fragile sentiment with a stronger-than-expected reference rate for the yuan and the largest injection of short-term cash to the financial system since February. So far the steps have failed to restore optimism, with the US Treasury warning about the consequences for the global economy.

Still, markets are not yet fully reflecting the risks from China’s deteriorating fundamentals, according to Tiffany Wilding, an economist and managing director at Pacific Investment Management Co.

Article content

“Given the usual lags, deflationary spillovers have likely only just begun to impact global consumer markets,” Wilding wrote in a note to clients. “Discounting likely to accelerate over the coming quarters.”

Corporate Highlights:

- London-listed BAE Systems Plc is in talks on a possible acquisition of Ball Corp.’s aerospace division, people with knowledge of the matter said.

- Intel Corp.’s $5.4 billion deal with Israel’s Tower Semiconductor Ltd. collapses after failing to win Chinese regulatory approval in time.

- Energy Transfer LP will buy Crestwood Equity Partners LP in a $7.1 billion all-equity deal allowing Energy Transfer to expand its US pipeline network.

- Target Corp. climbs after a surprising profit surge in the second quarter overshadows the company’s increasingly cautious outlook on the rest of the year.

Key events this week

- US initial jobless claims, US Conf. Board leading index, Thursday

- Eurozone CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:08 a.m. Tokyo time. The S&P 500 fell 0.8%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 1.1%

- Nikkei 225 futures fell 0.3%

- Hang Seng futures fell 1.3%

- S&P/ASX 200 futures fell 0.3%

Article content

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0878

- The Japanese yen was little changed at 146.31 per dollar

- The offshore yuan was little changed at 7.3369 per dollar

Cryptocurrencies

- Bitcoin fell 0.3% to $28,840.2

- Ether was little changed at $1,809

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.25%

- Australia’s 10-year yield advanced three basis points to 4.23%

Commodities

- West Texas Intermediate crude fell 0.3% to $79.18 a barrel

- Spot gold rose 0.1% to $1,894.14 an ounce

This story was produced with the assistance of Bloomberg Automation.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation