Article content

(Bloomberg) — Former Treasury Secretary Lawrence Summers criticized moves to apply political pressure on the Federal Reserve over its aggressive interest-rate hikes, after two Democratic senators wrote the central bank chief this week.

Article content

“Political pressure is a fool’s game,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. On one hand, the Fed may become even more determined to tighten, in an effort to demonstrate its independence. On the other, public pressure could undermine investor confidence in the Fed’s campaign, he said.

Article content

Senate Banking Committee Chair Sherrod Brown, whose panel oversees the Fed, wrote Chair Jerome Powell this week calling on him to focus attention on the labor-market damage of tightening monetary policy. Fellow Democratic Senator John Hickenlooper separately called specifically on the Fed to pause its interest-rate hikes.

“Frankly, the Fed doesn’t listen — and, if anything, feels more pressure to prove its independence,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television. “So they don’t influence short-term rates and what the Fed actually does. But they do raise questions in the mind of market participants, and they raise long-term rates.”

Article content

Political pressure “actually probably makes financial conditions tighter than they otherwise would be,” he said.

While US job growth has continued, and the unemployment rate has dropped to match half-decade lows in recent months, some observers are concerned the most aggressive Fed tightening since the 1980s will tip the economy into a recession and put millions out of work.

Summers said that the problem is failing to contain inflation could — as the 1970s episode shows — “set the stage for much more financial instability and unemployment.”

Fed critics ought to explain why they think inflation is acceptable at a higher rate than the 2% target that monetary policymakers are aiming for, Summers said. Or, if they think that inflation will undershoot 2%, they should detail why the economy will go through such a wrenching downturn that it would pull consumer-price gains down so sharply, he said.

Article content

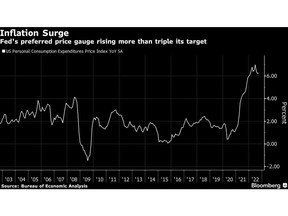

A report Friday showed that the Fed’s preferred inflation gauge rose 6.2% in September from a year before, more than triple its target. Excluding food and energy, core prices jumped 5.1%.

That’s even after the economy showed lackluster growth this year. Government data on Thursday showed that, adjusted for inflation, US gross domestic product in the third quarter was little changed from where it was in the final three months of 2021, after making up for a contraction in the first half of this year.

Read More: US Economy Shows Worst Yet to Come, as Cooling Just Starting

“What we’ve now had for nine months is essentially no GDP growth, and inflation on core measures probably stronger than it was at the beginning,” the former Treasury chief said. He added that a “soft-landing” scenario, where the US avoids a recession, “remains an enormous” challenge and unlikely outcome.