Article content

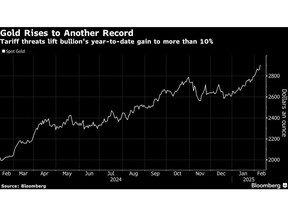

(Bloomberg) — Stocks in Asia are set to advance after US traders looked past concerns over tariff threats and toward Federal Reserve comments and inflation data. The dollar strengthened and gold hit a record.

Stocks in Asia are set to advance after US traders looked past concerns over tariff threats and toward Federal Reserve comments and inflation data. The dollar strengthened and gold hit a record.

(Bloomberg) — Stocks in Asia are set to advance after US traders looked past concerns over tariff threats and toward Federal Reserve comments and inflation data. The dollar strengthened and gold hit a record.

Article content

Article content

Futures indicated gains in Australia and a steady open in Hong Kong. Tokyo is closed for a public holiday. Technology again led a rally on Wall Street, as Nvidia Corp. extended a five-day surge to 15% while Meta Platforms Inc. rose for a 16th session. United States Steel Corp. and Alcoa Corp. followed a move higher in metals after President Donald Trump’s plans to impose 25% tariffs on all US imports of steel and aluminum. An index of American-listed Chinese shares rose for a third day.

Advertisement 2

Story continues below

Article content

Trump said Sunday the steel and aluminum tariffs would apply to shipments from all countries, including major suppliers Mexico and Canada. He didn’t specify when the duties would take effect. The president also said he would announce reciprocal tariffs this week on countries that tax US imports.

Aside from the global trade picture, investors will also be focused on this week’s key inflation data and Fed Chair Jerome Powell’s testimony before Congress. Expected inflation rates over the next year and three years ahead were both unchanged in January at 3%, according to results of the New York Fed’s Survey of Consumer Expectations published Monday.

“Inflation data, Powell’s congressional testimony, and tariffs are poised to drive the market story,” said Chris Larkin at E*Trade from Morgan Stanley. “If the S&P 500 is going to break out of its two-month consolidation, it may need a respite from the types of negative surprises — like DeepSeek, tariffs, and consumer sentiment — that have tripped it up over the past few weeks.”

Hedge funds emerged as big buyers of US stocks last week, shifting away from a previously bearish stance in the wake of stronger-than-expected earnings reports. They snapped up US equities at the fastest pace since November, resulting in the heaviest net buying of single stocks in more than three years, according to Goldman Sachs Group Inc.’s prime brokerage report for the week ended on Feb. 7. The activity was heaviest in the information technology sector.

Article content

Advertisement 3

Story continues below

Article content

The S&P 500 rose 0.7%. The Nasdaq 100 climbed 1.2%. The yield on 10-year Treasuries was little changed at 4.5%. The Bloomberg Dollar Spot Index gained 0.2%. Gold topped $2,900 an ounce. Oil advanced from near its lowest levels this year as shrinking Russian production eased concerns over a glut.

To Jose Torres at Interactive Brokers, many investors are starting to realize that much of the tariff talk is hardly going to come to fruition, with the rhetoric increasingly appearing to be a negotiation tactic.

“The posturing is intended to benefit domestic economic conditions rather than disrupt global commerce momentum, and the outcomes are likely to be much better than feared,” he said. “For this reason, traders are stepping up to the plate today and scooping up stocks.”

The resilience of stocks in the face of tariffs may invite further trade escalations, making equity pullbacks likely, according to Deutsche Bank AG strategists including Binky Chadha.

They noted these pullbacks require the same playbook as for geopolitical shocks, which have historically seen sharp but short-lived selloffs, with equities typically bottoming even as the event continues and recouping losses before any de-escalation.

Advertisement 4

Story continues below

Article content

In such scenarios, equities would typically weaken 6%-8%, moving lower for three weeks before gaining strength for three weeks.

“For investors, the greatest market risk likely lies in policy unpredictability,” according to Christian Floro at Principal Asset Management. “Given this environment, diversification is essential to manage portfolio risk and capture opportunities as companies, countries and markets adjust.”

Key events this week:

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Rita Nazareth.

Article content

Comments