Article content

(Bloomberg) — Asian equities climbed in early Monday trading, tracking US peers following a positive conversation between Donald Trump and Chinese leader Xi Jinping ahead of the US President-elect’s inauguration.

Asian equities climbed in early Monday trading, tracking US peers following a positive conversation between Donald Trump and Chinese leader Xi Jinping ahead of the US President-elect’s inauguration.

(Bloomberg) — Asian equities climbed in early Monday trading, tracking US peers following a positive conversation between Donald Trump and Chinese leader Xi Jinping ahead of the US President-elect’s inauguration.

Article content

Article content

Shares in Australia, Japan and South Korea gained. A gauge of US-listed Chinese shares jumped 3.2% Friday as Trump described the talk between the two leaders as “very good.” US futures were slightly lower in Asian trading with Wall Street closed on Monday due to a holiday.

Advertisement 2

Story continues below

Article content

Trump and Xi discussed trade, TikTok and fentanyl, which may set the tone for relations in the early days of the new administration. Adding to the positive sentiment, TikTok started restoring service in the US on Sunday as Trump said he would halt enforcement of a law requiring the app’s Chinese owner to find a buyer for three months.

“The amicable call between Trump and Xi, while only a temporary reprieve amidst irrevocable strategic competition, is extra fuel to reignite bullishness in equities,” said Kyle Rodda, a senior analyst at Capital.com in Melbourne. “It’s particularly telling that Asian indices ought to open firmer today because of the news, having barely moved after much stronger than expected Chinese growth data on Friday.”

Still, traders are bracing for the first days of the Trump’s second term. He’s planning a flurry of executive orders around immigration, energy, federal workers and regulatory reform, to quickly implement his policy agenda upon taking office. The plans are said to include tightening restrictions on border crossings and setting up the mechanics to carry out mass deportations.

Article content

Advertisement 3

Story continues below

Article content

“Financial markets are likely to be volatile in the coming weeks as they absorb the details of the incoming administration’s policies,” Barclays analysts including Ajay Rajadhyaksha wrote in a note to clients. “A hundred executive orders on day one itself – on areas as wide-ranging as border policy, tariffs, energy, deregulation, etc. – is likely to send investors scrambling to decipher them.”

Ahead of Trump’s inauguration later Monday, China’s commercial banks will announce their one- and five-year loan prime rates as the world’s number 2 economy suffers from chronic weakness in domestic demand. The rate will likely be on hold for a third straight month as the People’s Bank of China may be reluctant to reduce policy rates near-term due to pressure on the yuan, according to Bloomberg Intelligence.

The World Economic Forum’s annual meeting gets underway later Monday. Among the group of billionaires set to join the pilgrimage of the rich and powerful to Davos, Switzerland are Larry Fink, Ray Dalio and Marc Benioff. Trump will speak virtually to the gathering three days after his inauguration.

Advertisement 4

Story continues below

Article content

Traders will also be preparing for the Bank of Japan scheduled policy decision on Friday, with about three quarters of economists in a Bloomberg survey expecting it to hike its key rate. Overnight index swaps showed as much as a 99% chance of hike.

BOJ officials also see a good chance of a rate increase as long as Trump doesn’t trigger too many immediate negative surprises, Bloomberg reported on Thursday, citing people familiar with the matter.

Trump Memecoin

A digital token debuted by Trump has rattled the cryptocurrency market, attracting billions of dollars of trading volume while stoking concerns about conflicts of interest.

Meanwhile, the wider crypto market struggled, including a dip in the largest token, Bitcoin. It was down over 2% Monday.

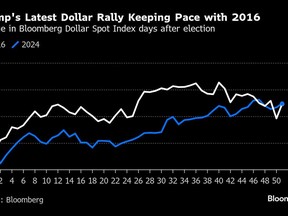

The Bloomberg gauge of the greenback has risen over 5% in the 10 weeks since Election Day, only to snap its six-week rally on Friday. The advances have been similar to the gains it posted after Trump’s 2016 victory. Underpinning the move is a corresponding weakness in global currencies considered at risk from Trump’s economic policies, including the euro and Canadian dollar.

Advertisement 5

Story continues below

Article content

China’s yuan has also lost more than 3% versus the dollar since Nov. 5, due to tariff risks and a widening gap between US and Chinese government bond yields. The People’s Bank of China has deployed various tools to support the currency, and depreciation expectations have been trimmed since peaking in early December.

In commodities, oil was steady ahead of Trump’s inauguration.

Key events this week:

Advertisement 6

Story continues below

Article content

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Article content

Comments