Article content

(Bloomberg) — Oil rose ahead of the inauguration of President-elect Donald Trump, as the market braced for a period of uncertainty and turmoil at the start of his second term in the White House.

Article content

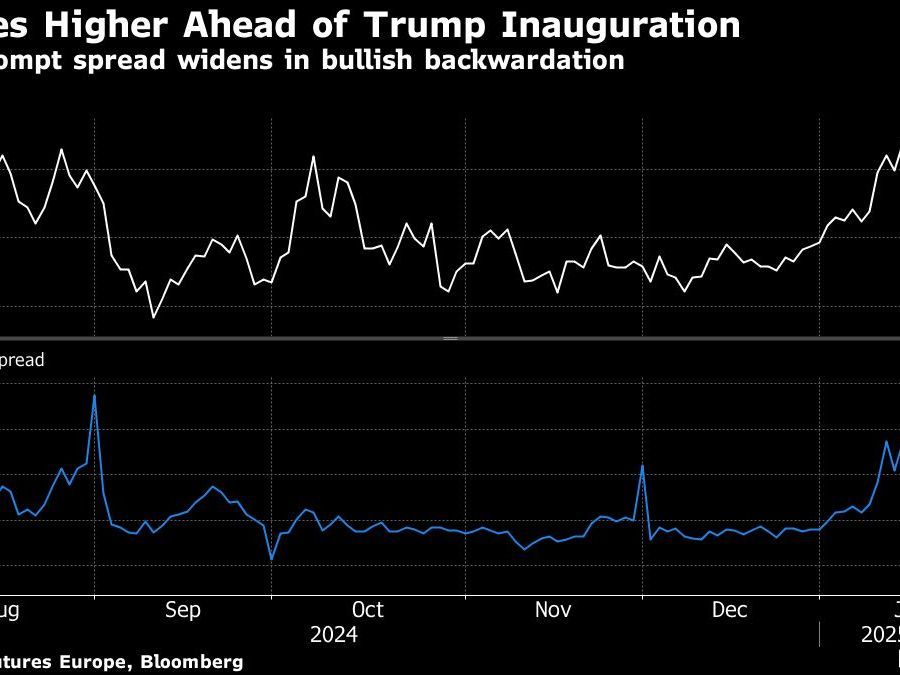

Brent traded above $81 a barrel after falling in the past two sessions, while West Texas Intermediate was near $78. Trump is planning a flurry of executive orders on day one including energy, has threatened hefty tariffs on China, Canada and Mexico, and could implement sanctions on Iran.

Article content

Crude has rallied at the start of the year, after frigid weather in the Northern Hemisphere drove higher heating demand and broader US sanctions on Russia’s oil industry left customers in Asia seeking alternative supplies. Trading volumes for Monday’s session may be lower due to a federal holiday in the US.

The additional sanctions on Russia have upended tanker markets, led to prices of Middle Eastern crude surging and Brent’s prompt spread widening in a bullish backwardation structure. Speculators have increased their long-only positions on Brent, although there’s been a buildup of shorts.

Scott Bessent, Trump’s nominee for Treasury secretary, said last week he would support dialing up measures targeting Russia’s oil industry, which would likely mean even more disruption. The President-elect’s pick for national security adviser has previously vowed “maximum pressure” on Iran.

Meanwhile, a ceasefire in Gaza has begun, leading to a suspension of prolonged hostilities. The Qatari and Egyptian-mediated deal backed by the US stipulates an initial six-week truce during which 33 hostages will be freed by Hamas in return for hundreds of Palestinians jailed by Israel.

To get Bloomberg’s Energy Daily newsletter in your inbox, click here.

Share this article in your social network