Article content

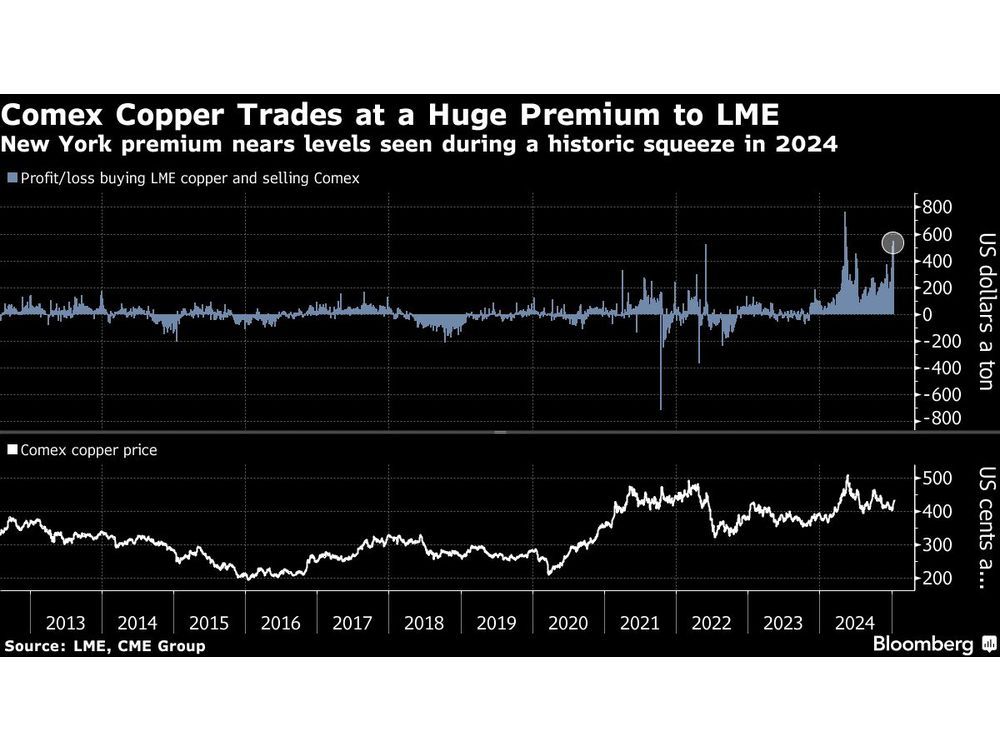

(Bloomberg) — US prices of metals and oil are surging above their international counterparts as traders increase bets President-elect Donald Trump will impose tariffs on imported goods.

Article content

Metals including copper, silver and platinum are seeing a price dislocation between London and New York in recent weeks, while differentials in oil prices between the US and Canada also have increased.

Article content

The spikes come as apprehension and uncertainty loom over the scope of Trump’s global trade policies and create opportunities for traders to buy cheaper goods overseas and deliver them into the US.

Markets are pricing in “a higher likelihood of US tariffs on imports (whether broad, country specific, or critical minerals specific),” said Citigroup analysts led by Max Layton. As a result, the analysts recommend using US contracts to hedge broad tariff risks.

The president-elect repeatedly has suggested he’ll impose a 10% to 20% tariff on all foreign goods and 60% or higher on products from China. Members of Trump’s incoming economic team are discussing slowly ramping up tariffs month by month, a gradual approach aimed at boosting negotiating leverage while helping avoid a spike in inflation, Bloomberg News reported Monday citing people familiar with the matter.

For platinum and copper, the surge in their US premiums to London prices suggested traders were assigning “a 45%-55% chance of a 10% broad tariff and/or 10% critical mineral specific tariff,” the Citi analysts wrote in a Tuesday note.

Article content

As for oil and aluminum, the price differentials reflected potential country-specific tariffs that may be imposed on Canada, they added.

The analysts see platinum as the most likely metal to be impacted by broad tariffs even if there are exemptions. That’s because the US is a large net importer of the metal, with a minimum amount coming from countries with free-trade agreements with US. Platinum is used in auto catalysts in diesel-powered automobiles.

Gold and silver may be exempt from broad tariffs thanks to their monetary use in coins as legal tender in the US and because they are not considered critical minerals, according to the analysts. A “tariff on gold imports is highly unlikely given its reserve asset status,” they added.

If a 25% tariff on Canada including on energy is imposed, US refiners and consumers could face higher crude, gasoline and diesel prices of the same amount, especially in places without alternatives, the analysts said.

Share this article in your social network