Article content

(Bloomberg) — Banks are dumping assets and many of them are turning to a booming sector of the bond market to do so.

The latest round of global capital rules, known as Basel III endgame, is expected to make a whole slew of loans more expensive for banks to hang onto. In response, the lenders are bundling more auto loans, equipment leases, and other kinds of debt into asset-backed securities.

Article content

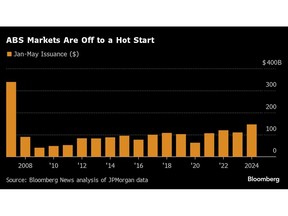

In the US alone, ABS sales have topped $170 billion this year, up about 38% from this time in 2023, according to data compiled by Bloomberg News. Europe has seen similar gains: issuance was about €21 billion ($22.9 billion) this year, up about 35% from the same point last year, according to data compiled by Bloomberg that excludes mortgage securities.

And the tide of issuance doesn’t seem to be ebbing. Bank of America strategists on May 31 raised their full-year US sales predictions for the bonds, to about $310 billion from their previous $270 billion, mainly because of auto loan securitizations. The bonds are finding ready buyers among credit investors, with attendees at a global ABS conference in Barcelona this week expressing cautious optimism about the market.

“We see attractive opportunities in asset-backed securities,” particularly those linked to US households, said Kay Herr, JPMorgan Asset Management’s chief investment officer for US fixed income, in the Credit Edge podcast. “We absolutely see opportunities for yield pickup there.”

Banks’ use of significant risk transfers, which are a cousin of ABS, is also driving issuance, running at its hottest pace since the 2008 financial crisis crushed the market.

Article content

“A lot of the SRT deals have been in the US up to now,” Andrew South, head of structured finance research at S&P Ratings, said at a conference this week. “With a lot of regulatory changes on the Basel 3.1 side, there could be more incentives for banks to use securitization for capital relief,” he added.

One sign of the robust demand is that investors looking for securities with relatively strong ratings and high yields have snatched up asset-backeds supported by increasingly exotic assets, including art from Rembrandt van Rijn and Andy Warhol, and internet protocol addresses.

“We are getting a lot of enquiries about esoteric securitizations,” said South, citing data center and solar panel securitizations as two examples.

To be sure, issuers could be pulling their sales forward to avoid any volatility from the US presidential election or a Federal Reserve monetary policy pivot, according to strategists. That dynamic could result in a much slower second half of the year.

Wall Street chief executives have been vocal in their complaints about the Basel III endgame rules. JPMorgan Chase & Co.’s Jamie Dimon said hedge funds and other firms outside the banking system were excited for the business they would gain from the regulations.

Article content

“They’re dancing in the streets,” Dimon said last year.

Regulators seem to be listening. In March, Federal Reserve Chair Jerome Powell said the central bank was planning “broad and material changes” to the central bank’s implementation of the rules, and that a complete overhaul was possible.

But even so, the banks’ preparations for tougher new capital rules is evidenced by the growing issuance of ABS. Lenders in recent days have lined up a passel of new deals for sale next week, including auto bonds from Santander and Toyota.

Week in Review

- Private credit is having a taste of what happens when things turn ugly. Higher interest rates are making it harder for many companies to service their debt, while lenders flush with cash are undercutting each other on pricing and offering unusually borrower-friendly terms. Some warn it’s laying the groundwork for more pain ahead.

- A group of investors in Credit Suisse Group AG bonds that got wiped out when UBS Group AG rescued the bank in a Swiss government-brokered deal are suing the country in New York as they take their fight abroad.

- Asian borrowers are returning in greater force to global debt markets, joining others worldwide that are contributing to near-record levels of activity this year.

- Banks are ramping up investments in a complex part of the mortgage bond market that offers shorter-term securities, as they cope with the growing risk of their losing deposits amid high rates.

- Deutsche Bank AG plans to sell a credit-linked note known as a significant risk transfer that’s tied to a pool of about $2 billion in leveraged loans.

- Gym chain Planet Fitness sold $800 million in bonds backed by franchise agreements, intellectual property and equipment sales to refinance some of its debt.

- Coastal GasLink LP, a pipeline project in Western Canada, sold C$7.15 billion ($5.22 billion) of notes in the largest loonie-denominated corporate bond deal ever.

- Pipeline operator Energy Transfer LP sold $3.95 billion of investment-grade and high-yield bonds to fund its acquisition of WTG Midstream.

- Thoma Bravo has reached out to private credit lenders as it seeks to raise around $3.5 billion in fresh financing for its automated professional services provider ConnectWise.

- HSBC Holdings Plc looked into offloading at least part of its debt position in beleaguered utility Thames Water before choosing not to proceed.

- Suntory Holdings Ltd.’s $500 million bond sale makes the whiskey producer an outlier among Japanese companies, who are decreasing dollar debt sales while rushing to raise yen funds.

- A group of lenders asked a court to impose bankruptcy oversight on multiple units tied to the struggling Indian education technology company Byju’s, claiming millions of dollars are being “siphoned” out of the companies.

- Dealmaking is poised to accelerate this year as private equity and private credit funds face renewed pressure to return money to their investors, participants at the SuperReturn International conference in Berlin said.

- The European Central Bank is reviewing how the region’s biggest banks lend to the private equity industry amid a rising threat of corporate defaults.

On the Move

- Toronto-Dominion Bank recruited Goldman Sachs Group Inc. veteran Paul Mutter to lead global sales for its fixed-income business.

- Millennium Management hired Steven Sasson, co-head of structured credit at Silver Point Capital.

- BlackRock Inc. has named Yik Ley Chan to lead the firm’s private credit efforts in Southeast Asia.

- Arini, an alternative-asset manager, hired former Goldman Sachs Group Inc. executive Nabil Aquedim as head of real estate and asset-backed strategies.

—With assistance from James Crombie.

Share this article in your social network

Comments