Article content

(Bloomberg) — Shares in Asia slipped Monday, tracking a fall in US equities, as markets grappled with ratcheting tensions after Iran’s unprecedented attack on Israel at the weekend.

Equity benchmarks in Japan, South Korea and Australia all declined while Hong Kong stock futures also fell. Contracts for US shares edged higher in Asia after the S&P 500 suffered its worst session since January on Friday amid a flight to safety.

Article content

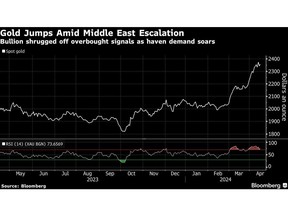

With investors already rattled by sticky inflation and the prospect of higher-for-longer interest rates, the escalation of the Middle East crisis risks injecting fresh volatility into markets. As the conflict widens, many say oil could surpass $100 a barrel and expect a flight to Treasuries, gold and the dollar, along with further stock-market losses.

Most Group-of-10 currencies strengthened against the greenback Monday while Treasures steadied in early Asian trading after yields slipped in the previous session. Gold rose amid driving demand for haven assets, while aluminum jumped more than 6% after US-imposed sanctions on Russian trading.

“The escalated tension over the weekend has unfortunately introduced new bitter uncertainties for the financial world to digest,” said Hebe Chen, an analyst at IG Markets. In Asia “the financial and tech sectors may experience the deepest pain — higher energy prices are likely to darken the shadow on the inflation trajectory, resulting in higher rates for a longer period.”

In Asia, Chinese equities are set for a tough week after a miss in the nation’s trade data Friday. Even if the global risk mood improves and Middle East tensions subside, Chinese stocks may see headwinds of their own to overcome.

Article content

Elsewhere, developer China Vanke Co. said it’s making plans to resolve liquidity pressure and short-term operational difficulties as China’s top leaders have grown increasingly alarmed about the country’s protracted real estate crisis and its effect on the sluggish economy.

War Nerves

While Iran said “the matter can be deemed concluded,” traders are now waiting to see if the conflict spirals into a widespread regional war. Still, nerves may be tempered following a report that President Joe Biden told Israeli Prime Minister Benjamin Netanyahu that the US won’t support an Israeli counterattack against Iran.

“For markets this may eventually play out as a fade as Iran and Israel step back from the brink,” said Namik Immelbäck, chief strategist at Skandinaviska Enskilda Banken AB. “But near term this should lead to position reduction from especially trend following quant strategies” which should exacerbate the typical flight to safety, he said.

Read More: Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War

Bitcoin rallied after it sank almost 9% in the wake of the attacks on Saturday. Stock markets in Saudi Arabia and Qatar posted modest losses under thin trading volumes on Sunday. Israel’s equity benchmark fluctuated between gains and losses at least nine times before closing with a small gain.

Article content

Oil shrugged off Iran’s the attacks, with gains held in check by speculation that the conflict would remain contained. Brent crude is already up almost 20% this year and last traded around $90 a barrel.

Traders will soon shift to looming economic data as they refine bets on central bank easing cycles, as well as the International Monetary Fund and World Bank spring meetings in Washington. This week, Chinese growth data and Japan, Eurozone and UK inflation readings are due.

Key events this week:

- Eurozone industrial production, Monday

- US retail sales, empire manufacturing, business inventories, Monday

- Federal income taxes due in the US, Monday

- IMF and World Bank spring meetings start in Washington, Monday. The main ministerial meetings will be held April 17-19

- Canada CPI, Tuesday

- China property prices, retail sales, industrial production, GDP, Tuesday

- UK jobless claims, unemployment, Tuesday

- New Zealand home sales, CPI, Wednesday

- Eurozone CPI, Wednesday

- UK CPI, Wednesday

- Australia unemployment, Thursday

- Japan CPI, Friday

- India’s elections begin, Friday

Article content

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 9:20 a.m. Tokyo time

- Hang Seng futures fell 1.7%

- Japan’s Topix fell 1.4%

- Australia’s S&P/ASX 200 fell 0.6%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0645

- The Japanese yen was little changed at 153.31 per dollar

- The offshore yuan was little changed at 7.2658 per dollar

- The Australian dollar was little changed at $0.6472

Cryptocurrencies

- Bitcoin rose 2.7% to $65,587.35

- Ether rose 2.2% to $3,136.3

Bonds

- The yield on 10-year Treasuries was little changed at 4.53%

- Australia’s 10-year yield declined four basis points to 4.22%

Commodities

- West Texas Intermediate crude fell 0.1% to $85.54 a barrel

- Spot gold rose 0.7% to $2,360.82 an ounce

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network

Comments