Article content

(Bloomberg) — Equity markets in Asia look set to open higher as the Federal Reserve reiterated it’s in no rush to cut interest rates and will await more evidence that inflation is under control.

Futures contracts for the Nikkei 225 index pointed higher, while trading is still closed in Australia and Hong Kong due to holidays.

Article content

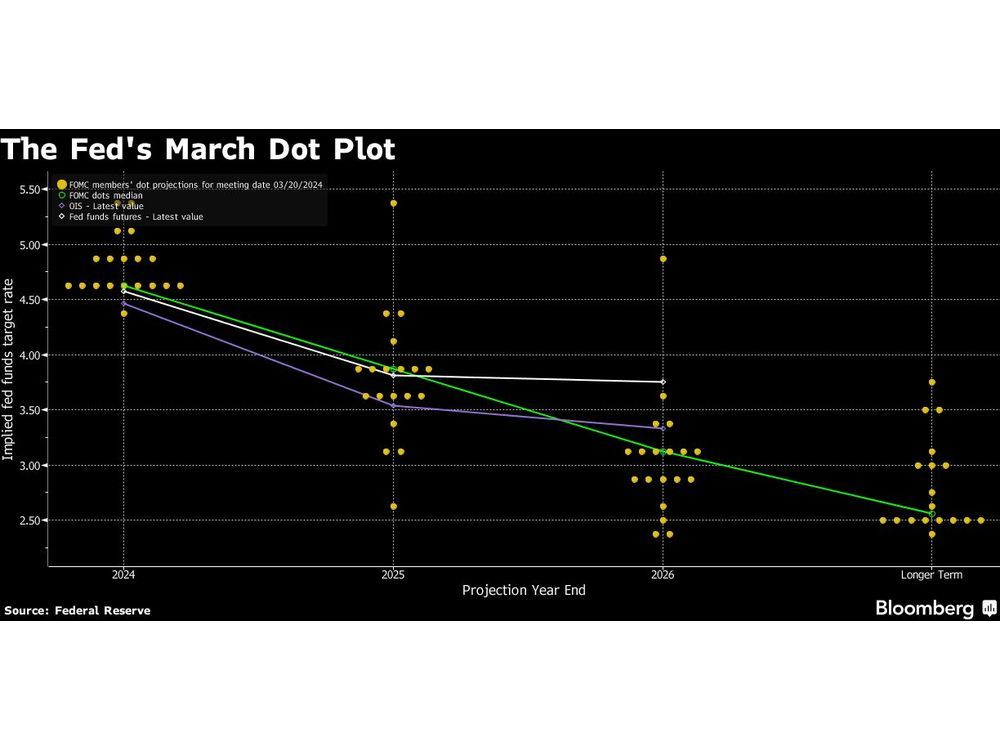

Fresh inflation released Friday was “pretty much in line with our expectations,” Chair Jerome Powell said, adding it would not be appropriate to lower rates until officials are sure inflation is on track toward 2%. Investors are now betting the US central bank will make that first cut in June.

Article content

“You have a Fed that at the moment is highly data dependent,” said Matthew Luzzetti, chief US economist at Deutsche Bank. “Until we get either confirmation or a different view on what the data are going to be, it’s kind of hard to gauge exactly where we end up from a Fed policy perspective.”

In China, the official manufacturing purchasing managers index expanded in March for the first time since September, the National Bureau of Statistics said in a statement Sunday. The reading suggests that the world’s second-largest economy has maintained traction after a solid start to the year and may give policymakers more time to assess the impact of previous stimulus measures.

China has set a target to increase gross domestic product by about 5% this year, which many economists regard as elusive, given the protracted slump in the property sector and persistent deflationary pressures.

“The industrial sector seems to be resilient, partly helped by strong exports,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “If fiscal spending rises and exports remain strong, the economic momentum may improve.”

Article content

Investors will be keeping a close eye on Treasuries Monday as trading resumes during Asian hours. The dollar was mixed and moved within tight ranges against a Group-of-10 peers, with a gauge of greenback strength ending the quarter higher.

Wall Street traders sent the S&P 500 to its 22nd record this year late last week. A $4 trillion surge in US equity values in just three months has startled doomsayers, while leaving a host of strategists scrambling to update their 2024 targets.

Elsewhere, Bitcoin traded above $70,000. The largest digital currency has jumped almost 70% this year amid persistent demand for US exchange-traded funds holding the token.

Key events this week:

- China Caixin manufacturing PMI, Monday

- Indonesia CPI, manufacturing PMI, Monday

- Japan Tankan business sentiment, manufacturing PMI, Monday

- Macau casino revenue, Monday

- Pakistan trade, CPI, Monday

- Singapore home prices, Monday

- South Korea trade, manufacturing PMI, Monday

- Taiwan manufacturing PMI, Monday

- Vietnam manufacturing PMI, Monday

- US construction spending, ISM Manufacturing, Monday

- Bank of Canada issues business outlook and survey of consumer expectations, Monday

- Eurozone S&P Global Manufacturing PMI, Tuesday

- France S&P Global Manufacturing PMI, Tuesday

- Germany S&P Global / BME Manufacturing PMI, CPI, Tuesday

- India HSBC/S&P Global Manufacturing PMI, Tuesday

- Mexico international reserves, Tuesday

- South Korea CPI, Tuesday

- Spain unemployment, Tuesday

- UK S&P Global / CIPS Manufacturing PMI, Tuesday

- US factory orders, light vehicle sales, JOLTS job openings, Tuesday

- Brazil industrial production, Wednesday

- China Caixin services PMI, Wednesday

- Eurozone CPI, unemployment, Wednesday

- Japan services PMI, Wednesday

- Hong Kong retail sales, Wednesday

- US ISM Services, Wednesday

- Eurozone S&P Global Services PMI, PPI, Thursday

- India services PMI, Thursday

- US initial jobless claims, trade, Thursday

- Eurozone retail sales, Friday

- France industrial production, Friday

- Germany factory orders, Friday

- Hong Kong PMI, Friday

- India rate decision, Friday

- Japan household spending, Friday

- Philippines CPI, Friday

- Russia GDP, Friday

- Singapore retail sales, Friday

- South Korea current account balance, Friday

- US unemployment, nonfarm payrolls, Friday

Article content

Some of the main moves in markets:

Stocks

- Nikkei 225 futures rose 0.4% as of 6:35 a.m. Tokyo time

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0794

- The Japanese yen was little changed at 151.30 per dollar

- The offshore yuan was little changed at 7.2564 per dollar

- The Australian dollar was little changed at $0.6519

Cryptocurrencies

- Bitcoin was little changed at $70,878.54

- Ether rose 0.1% to $3,637.5

Bonds

- The yield on 10-year Treasuries was unchanged at 4.20%

- Japan’s 10-year yield advanced two basis points to 0.725%

- Australia’s 10-year yield was unchanged at 3.96%

Commodities

- Spot gold rose 1.6% to $2,229.87 an ounce

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network