Article content

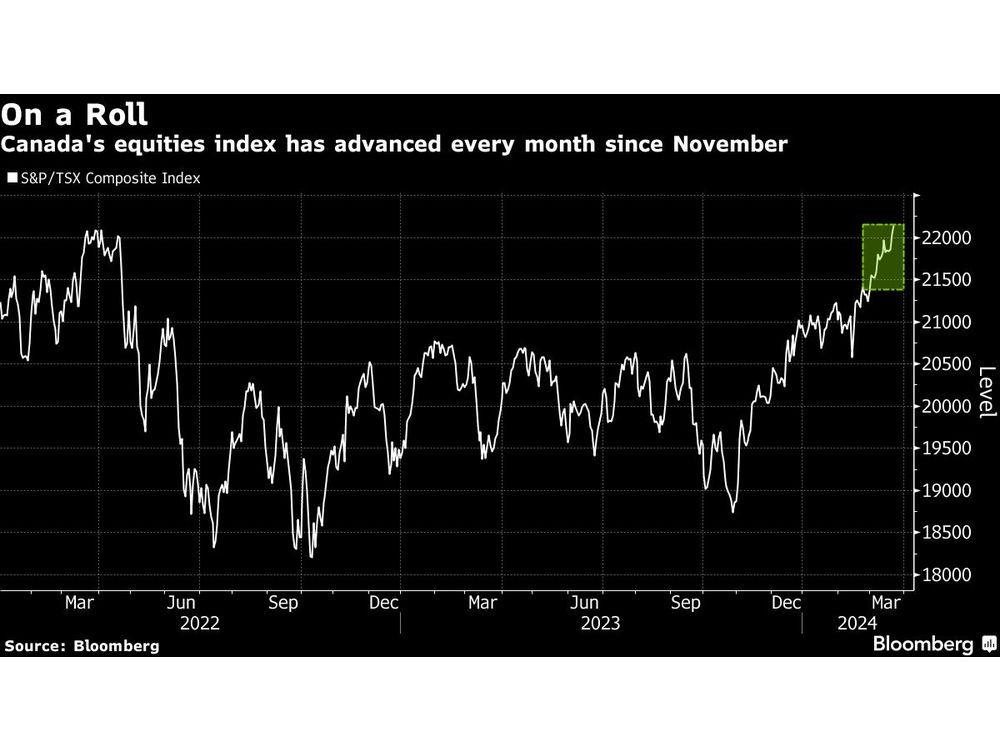

(Bloomberg) — Canada’s equities benchmark index closed at a new all-time high Thursday on the backs of bank stocks, surging commodity prices and a rally in the country’s growing tech sector.

The S&P/TSX Composite Index climbed to 22,087.26, setting its first record since 2022, as financial and real estate stocks led a broad-based rally. The country’s financial sector, which accounts for 31% of the index’s weighting, has climbed 4.2% in 2024.

Article content

“Even though Canada has its challenges economically right now we still have a very healthy core financial services industry, and that’s really what I think has driven the rally in the last four months,” Murray Wealth Group portfolio manager Jamie Murray said by phone, noting the gains have been strong since October.

Markets in Toronto are climbing as central bankers in the US and Canada signal that interest rate cuts are coming. The Bank of Canada sees the conditions for reducing rates materializing this year and quantitative tightening ending in 2025. On Thursday, deputy governor Toni Gravelle said February’s inflation data was “very encouraging.”

“I still think the trend is higher through 2024,” said Mike Archibald, vice president and portfolio manager at AGF Investments Inc. He added that corporate earnings could tick higher from here, helping lift Canada’s cyclical-heavy market.

The Canadian stocks benchmark passed the previous record of 22,087.22 reached in March 2022, when Russia’s invasion of Ukraine sent oil prices soaring, lifting energy shares. Tech companies Celestica Inc. and Blackberry Ltd. led the index higher on Thursday.

“I think in 2022, that was more speculative froth that drove the market higher because, obviously oil prices didn’t stay at $120 a barrel — they came back down,” said Philip Petursson, chief investment strategist at IG Wealth Management.

This time around, Petursson said, the Canadian economy is looking more resilient than expected and there are potential interest rate cuts on the horizon.

“There’s less froth in the market and more breadth and more participation,” he said. “This is a true recovery story.”

Share this article in your social network