Article content

(Bloomberg) — Vietnamese lender Southeast Asia Commercial Joint Stock Bank plans to issue the country’s first blue bond as part of a $150 million financing package from the International Finance Corporation.

IFC will subscribe the $25 million dollar-denominated five-year blue bond issued by the bank, as well as $50 million in five-year dollar-denominated green notes, according to a joint statement between IFC and the lender, known as SeABank.

Article content

Blue bonds are used to finance marine and ocean-based projects that are meant to have positive environmental, economic and climate benefits.

Proceeds from the blue and green bonds will be used by the Hanoi-based lender to expand its funding for activities such as sustainable aquaculture and fisheries, as well as investments in environmentally friendly buildings and renewable energy.

Vietnam will need about $368 billion through 2040 — with probably half from the private sector — to reach its goal of net-zero carbon emissions by 2050, said Thomas Jacobs, IFC country manager for Vietnam, Cambodia and Lao PDR.

Blue and green bonds can help Vietnam attract the level of financing it needs to address climate change, he said in an interview Monday. IFC is trying to help bring in new investors, he said.

The government’s commitment “to put Vietnam on the map in terms of climate finance” and the country’s strategic location in Asia are creating investor interest, Jacobs said. He noted that “there’s more to be done in terms of the regulatory environment for green and blue assets” in Vietnam and “it’s going to take some time.”

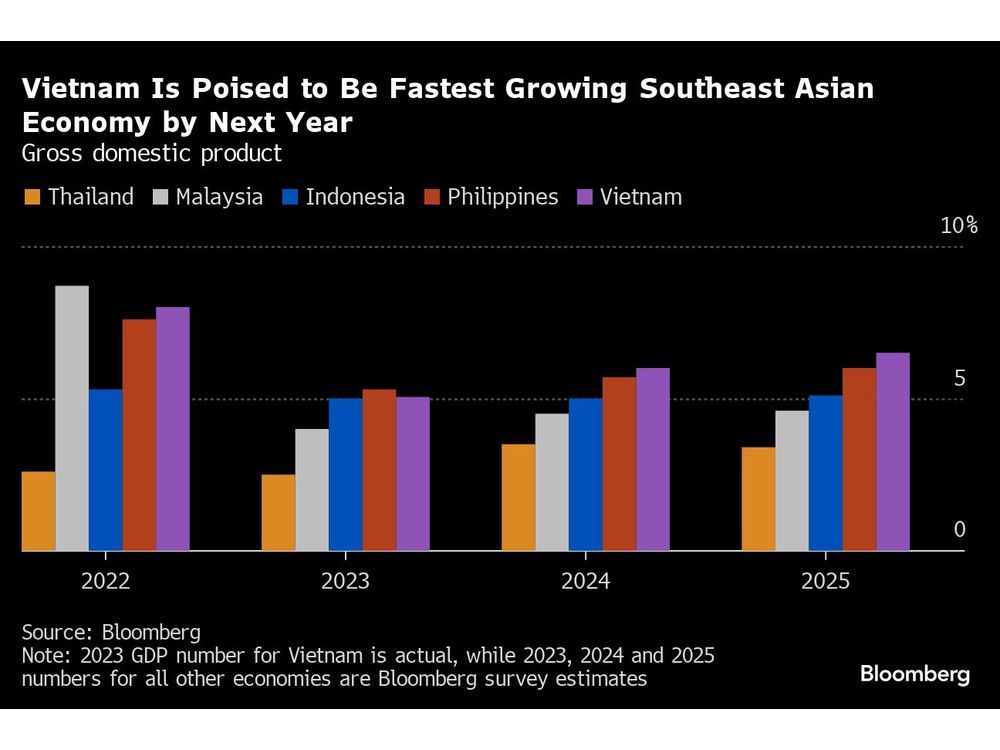

Vietnam is estimated to have experienced a loss of about 3.2% of gross domestic product in 2020 due to climate change, and the costs of it are expected to escalate rapidly, according to the joint statement.

In addition to the bonds, IFC will provide $75 million in loans to the lender for small and medium businesses, and to promote financial inclusion, it said.

(Updates with added details beginning in the fifth paragraph.)

Share this article in your social network