Article content

(Bloomberg) — The approaching US earnings season is expected to be the gloomiest since the pandemic, according to Goldman Sachs Group Inc. strategists.

Article content

Analyst consensus expectations are for S&P 500 earnings-per-share to fall 7% in the first quarter from a year earlier, marking the sharpest decline since the third quarter of 2020 and a low point in the profit cycle, strategists including Lily Calcagnini and David Kostin wrote in a note. “If analyst projections are realized, this quarter will represent the trough in S&P 500 earnings growth.”

Article content

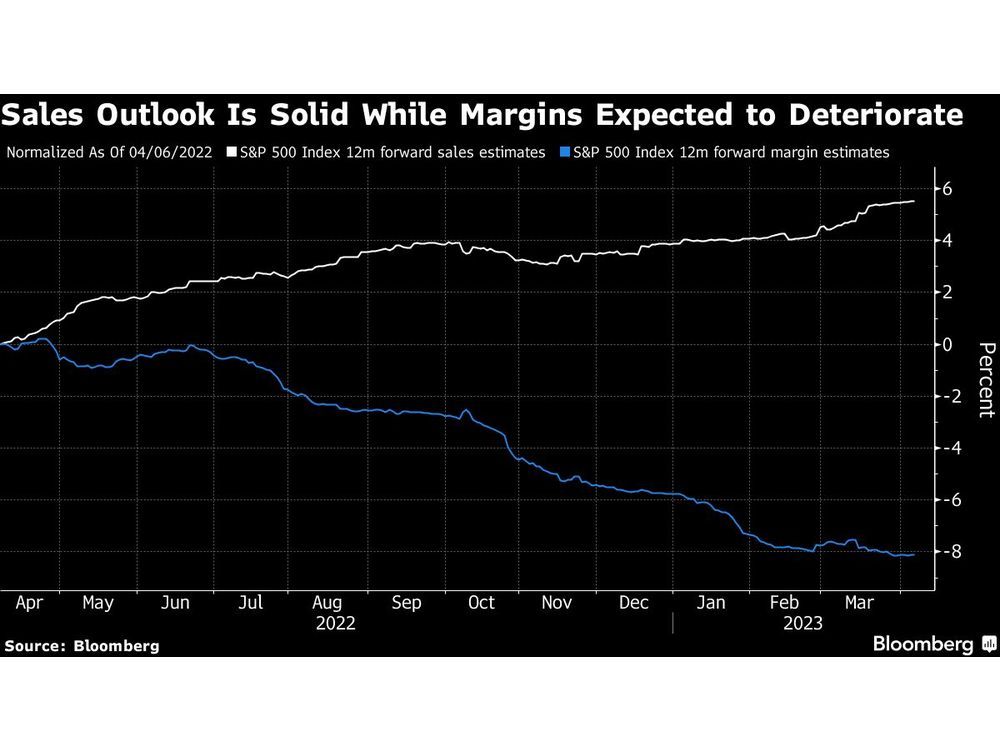

A deep contraction in margins will mostly outweigh modest growth in first-quarter sales. Just three sectors — energy, industrials and consumer discretionary — are forecast to report improved margins. The majority of other industries will likely see theirs shrink by more than 200 basis points, they said.

In February, Kostin — Goldman’s chief US equity strategist — said European and Asian stocks are better for investors to buy than US equities this year due to an expected decline in corporate profits in 2023. So far, Europe is slightly outperforming the US while Asia is lagging behind.

Article content

This earnings season will have added significance as traders parse statements for signs of an economic slowdown while assessing how companies have navigated the headwinds of higher rates, banking system stress and slowing demand. It officially kicks off on April 14 when large US lenders including JPMorgan Chase & Co. and Citigroup Inc. report results.

Investors will have four key topics in mind during the reporting season, according to the Goldman strategists: the outlook for margins, references to artificial intelligence, evidence of slowing cash use and signals of a China reopening boost.

Moreover, the earnings of smaller companies are more likely to be affected by the financial sector turmoil than larger firms, given they’re more economically sensitive and have greater exposure to regional lenders. And while banking earnings are expected to rise 11% from a year earlier, “uncertainty is elevated and investors will be focused on the path forward.”