Article content

(Bloomberg) — Only the greenest of UK’s commercial properties delivered positive investment returns over the last two-and-a-half years, according to a new sustainability index developed by CBRE Group Inc.

Buildings with the top A or B Energy Performance Certificate ratings posted annualized returns of 1.1% from the start of 2021 through the end of June even as rapid interest rate hikes roiled the sector, the broker’s gauge shows. That compares with a 0.6% loss on properties with ratings of C or lower, highlighting how the crisis engulfing commercial real estate has hit environmentally inefficient properties harder.

Article content

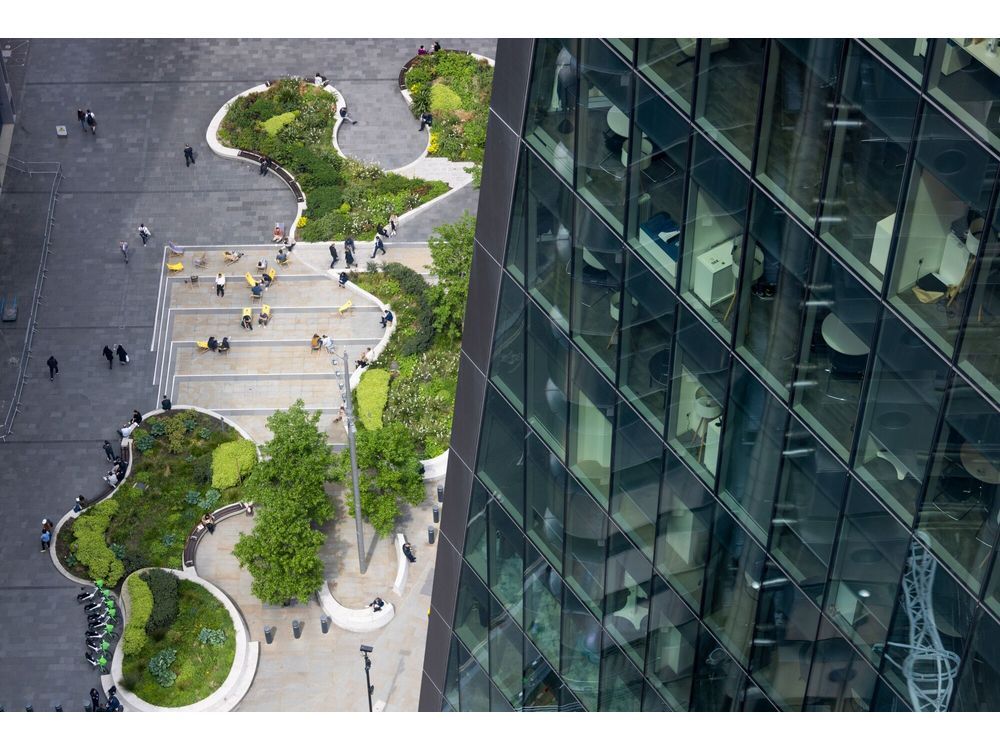

Companies are increasingly seeking out more energy efficient buildings as they rush to meet their own carbon reduction targets, meaning demand for space is concentrated on the best new buildings. At the same time investors are now factoring in the cost of upgrading less efficient buildings when weighing which assets to buy, lowering their valuations further.

“The outperformance of efficient assets is most pronounced in the office sector, present in the retail sector, and absent, for now, in the industrial sector,” said Sam Carson, CBRE UK’s head of sustainability valuation.

Quantifying that outperformance has been a challenge for investors, given the myriad of factors that impact property valuations. To create the index, CBRE analyzed more than 1,000 UK properties that it regularly assesses and collectively valued at £17.7 billion ($21.9 billion) at the end of June.

Both efficient and inefficient buildings in the sample registered positive rental growth over the initial period of the study, but larger declines in capital values meant the lower rated buildings registered overall negative returns.

“The CBRE Sustainability Index will allow us to see how energy efficiency is reflected in asset valuations into the future as we continue to track quarterly valuations against EPCs into 2024 and beyond,” CBRE senior research analyst Toby Radcliffe said. “This will give the market greater clarity on how sustainability, and specifically EPCs, affects investment performance and value in UK commercial real estate.”

Share this article in your social network