Article content

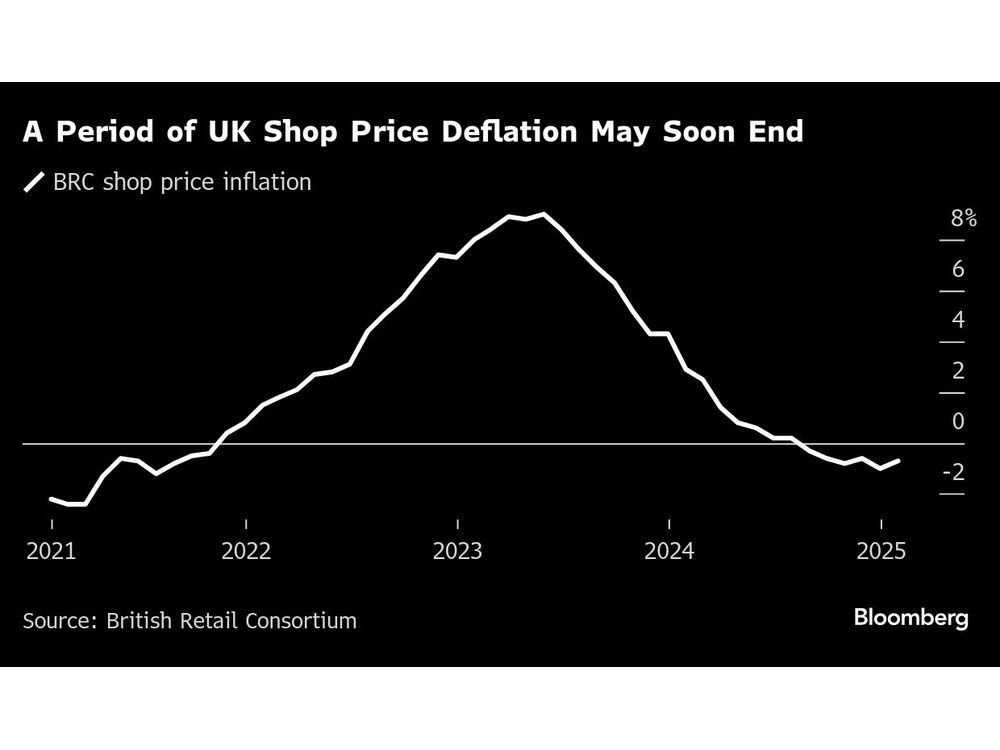

(Bloomberg) — UK food prices climbed at the fastest pace in nine months at the start of 2025, adding to a growing list of inflation threats for the Bank of England to grapple with at its crucial meeting next week.

Article content

The British Retail Consortium warned consumers to expect inflation to return in the shops after a 0.5% month-on-month jump in food prices in January, driven by chocolate and alcohol. They were 1.6% higher than a year earlier.

Article content

Overall, prices in shops fell 0.7% on the year after heavy discounting among non-food retailers in the January sales. However, that was less than the 1% fall seen in December.

The jump in food prices could be an early sign of a turning point on shop-price inflation as the BOE prepares to decide whether it can continue cutting interest rates at its meeting on Feb. 6.

The pace of rate cuts is being held back by multiple lingering inflation threats even though the economy is weakening, from higher energy costs to the fallout from a budget that added significantly to employment costs. Investors are still expecting a quarter-point cut from the BOE next week, one of just two fully priced in for this year.

“Price cuts and deflation may not last much longer as retailers will soon feel the full impact of £7 billion of new costs announced at the last budget,” said Helen Dickinson, chief executive of the British Retail Consortium. “This month’s figures also showed early signs of what is to come.”

The BOE says it is waiting to see how employers respond to the £26 billion ($32.5 billion) increase in payroll taxes and another large hike in the minimum wage, both announced by Labour in its first budget. Firms could lift prices, cut jobs and hours, restrain pay rises or take a hit to their profit margins.

The increase is already filtering through to the economy with grocery giant J Sainsbury Plc announcing it will cut 3,000 jobs last week.

Earlier this month, a BOE survey of chief financial officers showed that more than half of businesses plan to raise prices in response to the tax increase that comes into effect from April. Some 53% expected to reduce employment.

Share this article in your social network