Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

While living off cash sounds logical, the reality is you end up with less money in the long run than from equity investing

Article content

In 2020, when the country entered lockdown to prevent the spread of the fast-emerging COVID-19 virus, Bill* was offered and took a buyout package from his longtime employer, Bell Canada.

Advertisement 2

Story continues below

Article content

He was 58 and had worked for Bell for 32 years, or more than half his life. Divorced with two adult children, it was right around the time he and his ex-wife sold the family home they had purchased together. They split the sale price of $635,000.

Article content

“We just missed the buying frenzy,” he said.

Bill opted to move into a rental in Ottawa’s Byward Market rather than purchase another home. It was part of his strategy to ensure he has enough wealth to see him through retirement. His original plan was to retire at 60 — his current age — or possibly 61.

Article content

“I have a defined-contribution pension. It’s literally a pot of money. It’s not a guaranteed cheque each week or month,” Bill said.

To this point, Bill hasn’t touched the pension funds ($834,320) or any of his other investments. These include a registered retirement savings plan ($172,000) tax-free savings account ($74,000 invested in a balanced growth fund) BCE Inc. stock (worth $127,000 and pays quarterly dividends of $1,775), a non-registered investment account ($92,000 largely invested in bonds) and cryptocurrency stocks ($7,000).

Article content

Advertisement 3

Story continues below

Article content

Instead, he is drawing down from his cash savings ($217,000) to pay his living expenses. He carries no debt, and his biggest cost is rent, at $1,675 a month. In total, he spends about $3,200 each month, but he hasn’t started to travel yet, something he’d like to do.

This summer, Bill plans to take a two-week trip to Paris. In the winter, he may go to Florida and rent for a few months. He also has a friend with a place in Ecuador that he could cheaply rent. Overall, he anticipates his retirement will include a couple of trips a year. He also wants to leave money for his children if he can.

At this point, he plans to leave his pension with Bell, which has low management fees, and then convert it into a locked-in retirement account and withdraw funds as needed.

Advertisement 4

Story continues below

Article content

“My parents both lived into their 80s. I’m looking for a path to make sure I don’t run out of money,” Bill said. “I’m planning to start taking CPP (Canada Pension Plan) and OAS (Old Age Security) at 65, but would it be better to hold off until I’m 70? Am I spending too much? Do I have too much cash? Should that money be put in other places? How should I be drawing down funds to make sure it will last?”

What the experts say

“I’ve had many people come to me over the years in the same position as Bill. During the build-up years, they knew what to do, but they’re not so sure about how best to take that money out,” said Ed Rempel, a fee-for-service financial planner, tax accountant and blogger.

Bill’s total investments are a bit more than $1.5 million. A good number and one Rempel believes is enough for Bill to be able to enjoy the retirement he wants if he shifts cash into investments that reflect his risk profile and desired rate of return, and withdraws an appropriate percentage based on the types of investments he’s in (that is, conservative, moderate growth).

Advertisement 5

Story continues below

Article content

“Invest long term and then set up automatic monthly withdrawals to ensure tax efficiency,” Rempel said.

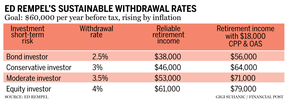

Based on current expenses and factoring an additional $10,000 each year needed for travel, Bill will spend about $48,000 net each year. That means he needs about $60,000 before tax, Rempel said.

“As long as he doesn’t get too conservative with his investments and he can invest effectively and tax-efficiently, I think he can be confident and live the lifestyle he wants,” he said.

Rempel said that living off cash sounds logical, but the reality is you end up with less money in the long run than from investing in equities.

“It’s a 30-year retirement and cash earns very little return,” he said. “Seventy to 80 per cent of retirement income is growth after retirement. If he’s 70-per-cent invested in equities, that generates more growth over time and he can take four per cent a year out. If he’s more of a moderate investor, I suggest withdrawing 3.5 per cent a year. That plus CPP will provide much more than he’s living on now.”

Advertisement 6

Story continues below

Article content

It’s a 30-year retirement and cash earns very little return

Ed Rempel

Rempel said the only reason to hold cash is for significant unusual purchases within a year or so, while an unsecured line of credit can be used to cover any emergencies.

Allan Small, senior investment adviser at iA Private Wealth Inc., agrees Bill has too much cash and should use that money to invest.

The first step will be for Bill to determine his risk tolerance. For example, if he wants to stay in low-risk investments, short-term bonds and high-interest savings accounts are paying close to five per cent and some money-market instruments are paying more than five per cent when upwards of $100,000 is invested.

“If he’s willing to take on medium risk, I would suggest buying dividend-paying stocks,” Small said. “Ultimately, this is a conversation he should have with a wealth management adviser and tax professional.”

Advertisement 7

Story continues below

Article content

Small also recommends converting the defined-contribution pension plan into an RRSP or locked-in retirement account to gain flexibility.

“If he takes that money and puts it into investments that generate a five-per-cent rate of return, that’s almost $42,000 that he can draw on that doesn’t touch the principal,” he said. “Or he could choose to grow those funds, and when he is ready to take an income, he will have more money to work with.”

Small points out that converting the pension plan will allow Bill to name his children as beneficiaries, giving them access to all the remaining funds in the account. This may not be the case with the pension plan.

With respect to when Bill should start taking CPP and OAS, Rempel said the most important considerations are how he invests and taxes.

-

Couple want to retire early, but are their government pensions enough?

-

Can we retire on $170,000 in savings and maintain our lifestyle?

-

What you need to know about picking an executor for your will

“I recommend he start CPP now and OAS at 65. This will allow him to pay the least amount of tax,” he said. “As well, he can’t leave CPP and OAS to his kids, while taking them early allows him to leave more of his investments in his estate.”

*Name has been changed.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation