Article content

(Bloomberg) — A sudden jump in the share prices of Chinese lithium producers is spurring optimism that a rout in the electric vehicle battery metal may be coming to an end.

China’s two biggest producers — Tianqi Lithium Corp. and Ganfeng Lithium Group Co. — closed up 6.5% and 7%, respectively, in Hong Kong on Wednesday. The sharp gains suggest investors may be positioning themselves for a recovery in prices.

Article content

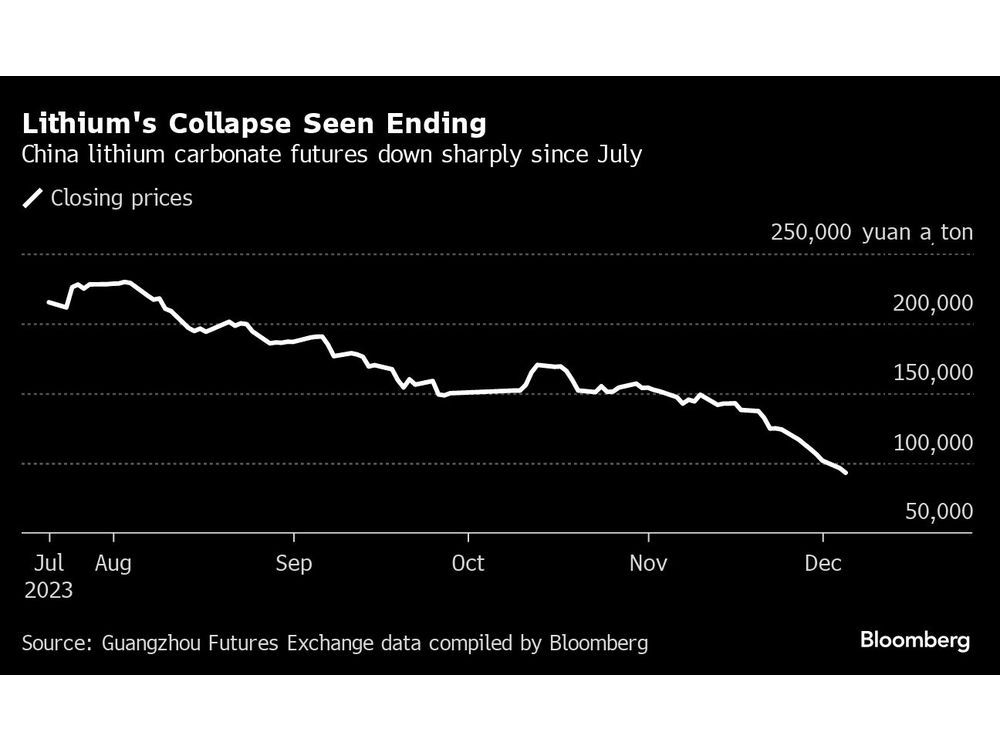

Lithium carbonate futures for January delivery on the Guangzhou Futures Exchange traded at 92,450 yuan ($12,915) a ton on Wednesday, down from more than 200,000 yuan when the bourse debuted the contracts in July.

The downward trend for lithium is “already nearing an end,” said Zhang Weixin, an analyst at China Futures Co. It’s likely to bottom out between 80,000 and 90,000 yuan a ton, he said.

While lithium prices may not go too much lower, a sharp turnaround appears unlikely. A massive expansion in supply and a slowdown in growth rates for EV sales have contributed to the slump, and Benchmark Mineral Intelligence doesn’t expect the global market to return to deficit until 2028.

“I think it’s fairly given that the lithium price will be very, very volatile,” Rio Tinto Group’s Chief Executive Officer Jakob Stausholm said in a Bloomberg Television interview on Wednesday. “And why, because sentiment for buying EVs goes up and down.”

Spot prices of lithium carbonate, a partially processed form of the metal, are down more than 80% from a peak last November to 98,500 yuan ($13,761) a ton.

Article content

Continued overcapacity in the market is inevitable, fueled by a surge in investment seeking to benefit from increasing energy transition demand in the years ahead, Yasmin Liu, chief integration officer at Tianqui Lithium, said at an industry conference in Shanghai on Wednesday. The right strategies to cope with price volatility are going to be key, she said.

Read More: Lithium Collapse Is Imperiling Supply, Top Miner Albemarle Says

In the longer term, the question is whether the current cycle of lower prices sees companies canceling or delaying plans for new mines or refineries, absent policy support from governments that are aiming to build out their own supply chains. Albemarle Corp., the world’s largest lithium producer, said last month that this is already starting to happen.

The plunge in lithium prices has almost reached a bottom, but an extended period of weakness is still likely, Wei Xiong, an advisor at raw materials trader Traxys, said at the conference in Shanghai. A turning point to monitor is “whether high-cost mines will exit,” he said.

—With assistance from April Ma and Haidi Lun.

Share this article in your social network