Article content

(Bloomberg) — South Korea’s exports have made a brisk start to the second quarter based on early trade figures for April, brightening the outlook for economic growth.

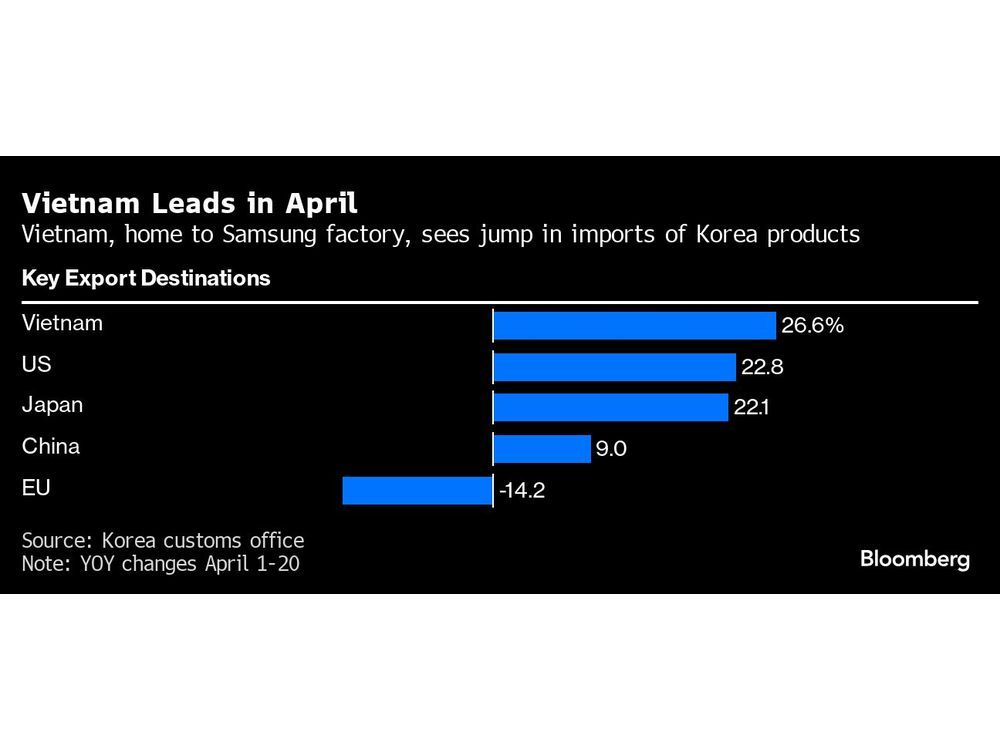

The value of shipments increased 11.1% from a year earlier in the first 20 days of April, according to data released Monday by the customs office. Imports rose 6.1%, resulting in a trade shortfall of $2.6 billion.

Article content

South Korea releases trade data earlier than most countries and is one of the world’s biggest producers of high-tech products, making its performance a leading indicator for broader trends in global commerce.

Artificial intelligence and other tech-driven developments have made the nation’s companies key players in global trade networks. Samsung Electronics Co.’s profit surged in the first quarter as its semiconductor and smartphone divisions began a turnaround.

Semiconductor shipments continued to lead growth in South Korean exports in April, rising 43% from a year earlier during the period, according to the customs office.

Technology products make up a large share of South Korea’s industrial strength and have likely helped shore up the economy at a time when consumption remains lukewarm. The Bank of Korea is set to release first-quarter economic growth statistics on Thursday, with economists estimating the expansion of gross domestic product accelerated to 2.5% year on year.

The momentum in exports has been felt in other parts of Asia, a region with factories that make advanced components in high-tech consumer products.

Article content

“Surging demand for AI-related hardware has driven exports for selected producers and economies,” Frederic Neumann, chief Asia Economist at HSBC Bank plc, said in a note. “Now, the trade recovery is broadening out.”

While demand for semiconductors has been a major source of momentum for South Korean exports, a key to the bigger picture is how other companies embedded across global supply chains perform, along with China’s economy.

Exports to China rose 9% in the first 20 days of April, the customs office data showed, an improvement compared with the same period in March. The US bought 22.8% more of South Korean products compared with the year earlier so far this month.

Geopolitical tensions and the uncertain outlook for US monetary policy may weigh on South Korean trade by hurting the won. The won briefly touched a key psychological level of 1,400 won per dollar last week, as bets on Federal Reserve rate cuts receded and Middle East tensions hurt risk appetite.

While a weaker won may help inflate earnings for some exporters, it poses challenges for companies that rely on imported materials to manufacture their products. It can also worsen domestic inflation because South Korea buys most of its energy from abroad.

(Updates with details and charts)

Share this article in your social network