Article content

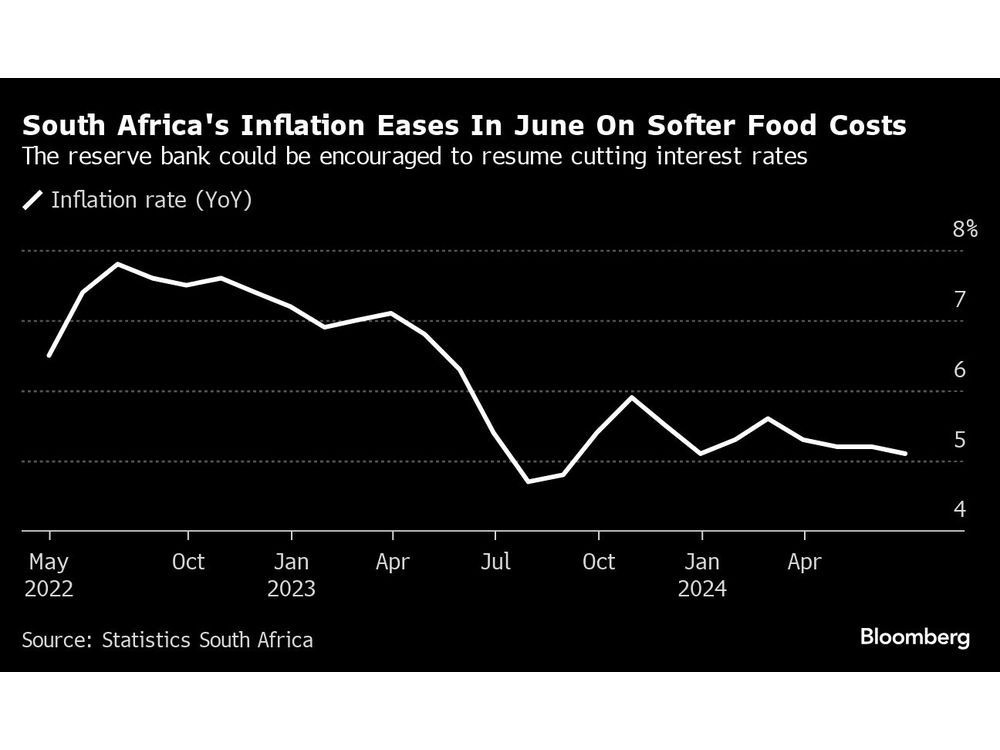

(Bloomberg) — South Africa’s inflation rate fell slightly in June, touching a six-month low and potentially encouraging the central bank to consider cutting borrowing costs later this year.

Consumer prices rose 5.1% in June from a year earlier, compared with 5.2% in the prior month, Pretoria-based Statistics South Africa said Wednesday in a statement on its website. That matched the median of 16 economists’ estimates in a Bloomberg survey.

Article content

Contributing to the change was a 4.6% rise in the food and non-alcoholic beverages category, which was the slowest gain since September 2020. Transport inflation cooled to 5.5%, from 6.3% in the prior month, while the new vehicle category slowed to 5.2%, coming down from a peak of 8.4% in September 2023, indicating weak demand.

The rand weakened slightly to trade at 18.38 per dollar at 10:35 a.m. in Johannesburg. Yields on government bonds were little changed after the release of the data, with the 10-year benchmark yielding 10.89%.

Rate Cuts

The data bolsters the reserve bank’s improved inflation outlook, which now sees prices slowing below the 4.5% midpoint of its target range in the fourth quarter. Officials have repeatedly stressed they won’t adjust policy until that goal is reached, but some of them have softened their hawkish stance.

The central bank’s six-member policy committee last week voted to leave interest rates at 8.25% but the decision was split, fanning hopes it was becoming more open to easing. Two wanted to cut rates by 25 basis points while four officials favored a hold, with Governor Lesetja Kganyago arguing there needs to be a sustained decline for officials to be confident inflation is under control.

Forward rate agreements – used to speculate on borrowing costs – are fully pricing in a 25 basis-point cut at the central bank’s Sept. 19 policy decision meeting.

The headline inflation rate rose to 0.1% from the prior month. Annual core inflation, which strips out food and non-alcoholic beverages, fuel and energy, eased to 4.5% from 4.6% in May and was 0.4% month-on-month.

—With assistance from Simbarashe Gumbo.

(Updates with more details, chart and market reaction)

Share this article in your social network