Article content

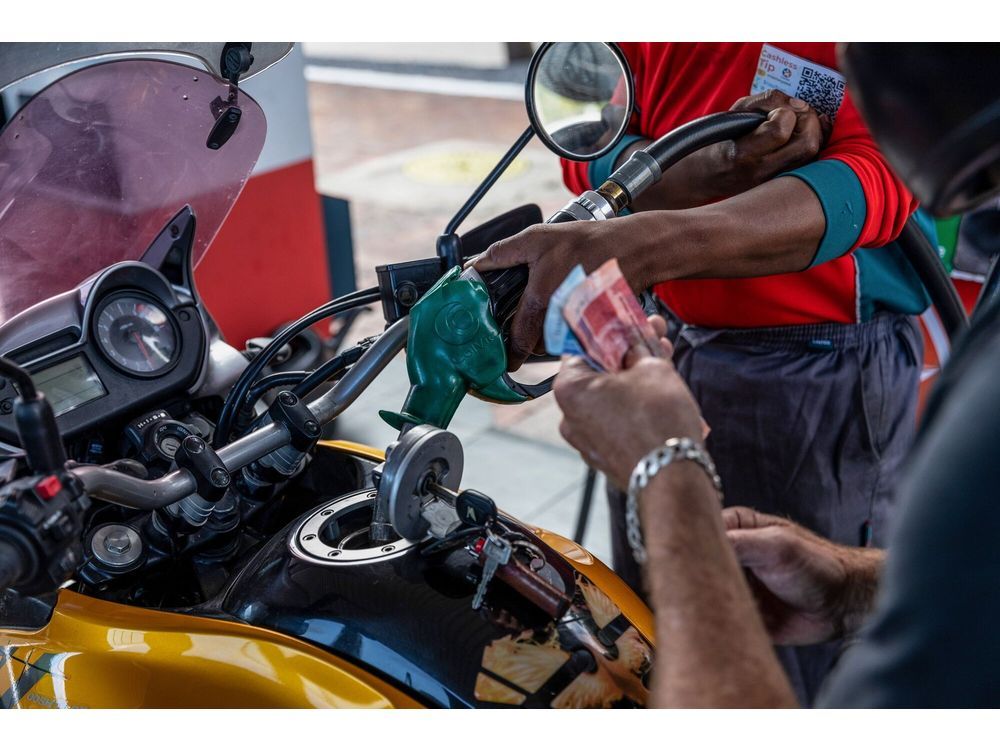

(Bloomberg) — South African inflation slowed amid a sharp decline in fuel prices although other categories remained elevated, sending mixed signals to the central bank, which has cautioned it remains wary of ongoing cost pressures.

The consumer price index rose 5.5% in November from a year earlier after a 5.9% gain in October, Pretoria-based Statistics South Africa said Wednesday in a statement. That was slightly above the 5.4% median of 16 economists’ estimates in a Bloomberg survey.

Article content

The latest reading sets inflation nearer to the midpoint of the central bank’s target band of 3% to 6%, where it prefers to anchor price-growth expectations. Policymakers have held their benchmark rate at a 14-year high of 8.25% since May. But tamer readings on inflation — if sustained — could encourage them to consider rate cuts in the first half of 2024.

Investors prior to the release of the inflation data had a tiny lean toward the Reserve Bank beginning to cut interest rates as soon as March, with a quarter-point reduction fully priced for its May meeting.

Month on month, the CPI fell 0.1% in November versus a 0.9% increase in October.

Core inflation, which excludes food and energy costs, ticked up to 4.5% in November from 4.4% the month before. Economists expected it to show a matching 4.4% increase in November.

Annual food-price inflation quickened to a four-month high of 9%, mainly driven by chicken-portion prices, which rose 7.3%, from 5.5% in the prior month, as an outbreak of avian flu continued to disrupt the country’s poultry market. Egg prices climbed 10.6% on a monthly basis, pushing the annual inflation rate for eggs to a boiling 39.9%.

—With assistance from Colleen Goko and Robert Brand.

(Updates with more details from the fifth paragraph.)

Share this article in your social network