Article content

(Bloomberg) — South Africa will need to urgently address crippling infrastructure bottlenecks or risk derailing a budding economic recovery, according to S&P Global Market Intelligence.

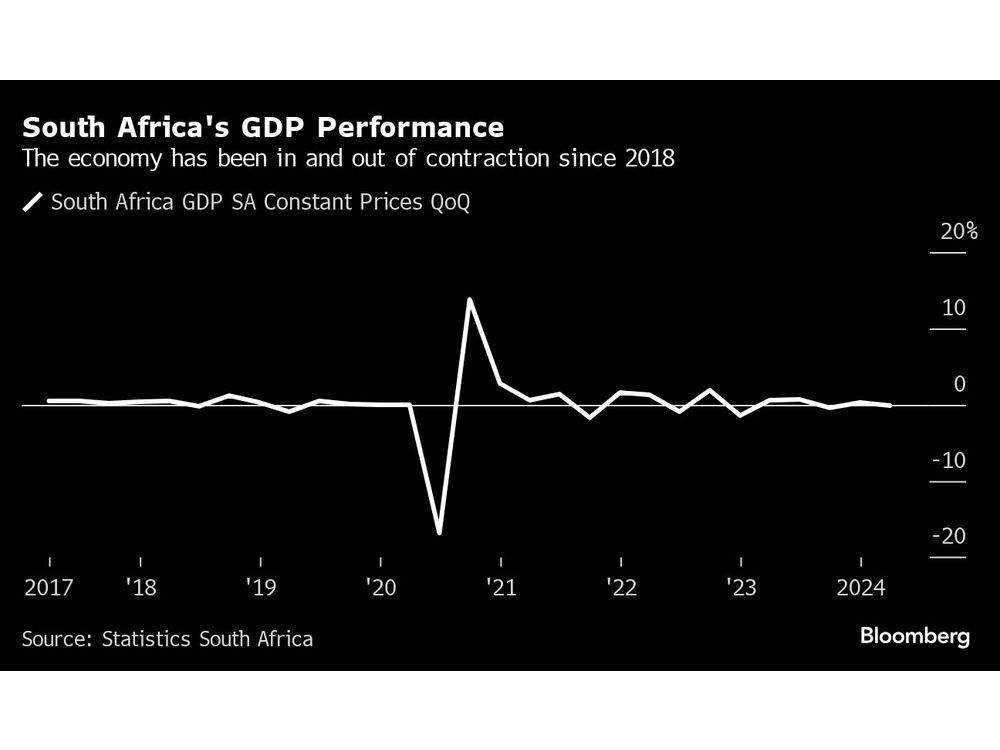

These challenges have left Africa’s most industrialized economy struggling to sustain growth for the last decade.

READ: South Africa Can Fix Backlogged Ports in a Year, Minister Says

Article content

Thea Fourie, Director for Sub-Saharan Africa Economics and Risk at S&P Global, warned that without urgent action, the country risks falling further behind.

“Addressing infrastructure bottlenecks in energy, ports, rail, and water is crucial for overcoming institutional weakness and driving growth,” said Fourie at a Bloomberg event Tuesday.

While the May elections brought a flicker of hope, providing a “window of opportunity,” success in making reforms sustainable would hinge on political stability and a focus on implementing genuine change.

The inefficiency with logistics and electricity remain significant constraints on growth according to S&P Global Ratings, which projects South Africa’s economy to grow by 1.1% in 2024 and an average of 1.3% over 2025-2027, from 0.6% in 2023. On a per capita basis, real growth will be about zero this year.

The rating company assesses the country’s foreign currency rating at “BB-/B” and local currency rating at “BB/B” with a stable outlook.

Critical reforms such as the Electricity Regulation Amendment Bill, which aims to reduce obstacles to the production and sale of electricity, could be pivotal in resolving the energy crisis that has plagued the nation. Similarly, the push to increase private sector participation in developing major ports like Durban and Richards Bay signals a positive shift toward unlocking economic potential, said Fourie.

She said the sustainability of the government of national unity, which had been met with much investor optimism, was a key risk, since there was the chance of “policy paralysis” as parties struggle to find common ground on important issues.

The African National Congress formed the government of national unity after a May 29 election cost it its parliamentary majority, leading to the party’s coalition with business-friendly parties including the Democratic Alliance, which has historically held divergent views.

Share this article in your social network