Article content

(Bloomberg) — Saudi Aramco followed oil-producing rivals by reporting blowout annual earnings and increasing its dividend, though its profit dipped in the fourth quarter as high interest rates slowed major economies.

Article content

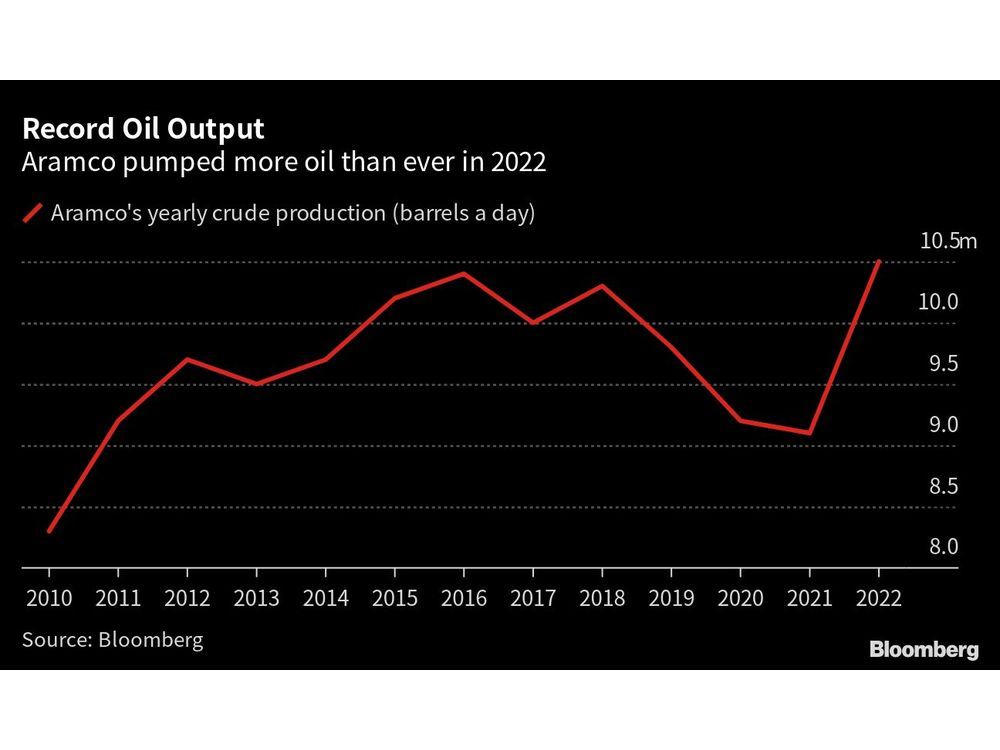

The world’s biggest energy company made net income of $161 billion in 2022, the most since it listed in Riyadh in 2019. Its performance was bolstered by record production and oil prices soaring to around $130 a barrel after Russia’s invasion of Ukraine.

Article content

Aramco unexpectedly raised its dividend — a crucial source of funding for the Saudi Arabian government — to $19.5 billion for the final quarter, a rise of 4% from the previous three-month period.

US and European peers such as Chevron Corp. and Shell Plc are returning billions of dollars to shareholders through larger dividends and buybacks. Aramco, until now, has instead focused on boosting output of oil and natural gas.

Crude prices have dropped since the middle of 2022 and have fallen another 4% this year, with Brent now trading below $83 a barrel. That’s been caused in large part by the US Federal Reserve staying hawkish on inflation and investors no longer anticipating that rates will be on a clear downward path by the second half of 2023.

Yet many traders still think oil will climb later this year, perhaps back to $100 a barrel, as demand strengthens in China with the reopening of its economy. Saudi Basic Industries Corp., a chemicals firm controlled by Aramco, saw profit slump in the fourth quarter as the global economic downturn weighed on consumption of everything from plastics to building materials.